Navigating the financial landscape of a nonprofit organization can often feel like a complex puzzle. You are not just managing income and expenses; you are also stewarding donor funds, demonstrating accountability to stakeholders, and ensuring your organization remains sustainable to fulfill its vital mission. Regular, transparent financial reporting is not merely a compliance task; it is a critical tool for strategic decision-making and building trust within your community.

Without clear insights into your financial health, it is challenging to identify trends, allocate resources effectively, or even plan for future growth. Many organizations struggle with pulling together comprehensive reports each month, often spending valuable time sifting through spreadsheets and disparate data points. This is where a well-structured system, like a robust nonprofit monthly financial report template, can truly make a difference.

Imagine having a clear snapshot of your organization’s financial standing at your fingertips, every single month. This article will explore the essential elements that make up a powerful financial report for nonprofits, guide you through the process of creating or adapting a template that suits your unique needs, and discuss how consistent reporting empowers your team and strengthens your mission.

Understanding the Core Components of a Nonprofit Financial Report

For any nonprofit, financial reports serve as the backbone of accountability and operational transparency. They are more than just numbers on a page; they tell the story of your organization’s financial journey, showing how resources are being generated and deployed to achieve specific programmatic goals. Donors, grantors, board members, and even your own team rely on these reports to understand the financial stewardship and impact of your work. Effective reporting ensures that everyone involved can make informed decisions based on accurate and timely data.

The primary goal is to present a clear and comprehensive picture of your organization’s financial activities over a defined period, typically a month. This involves detailing your assets, liabilities, net assets, revenues, and expenses in a way that is easy to understand, even for those without a strong financial background. A good report provides insights into both the big picture and the granular details, allowing stakeholders to grasp the overall financial health while also drilling down into specific areas of interest.

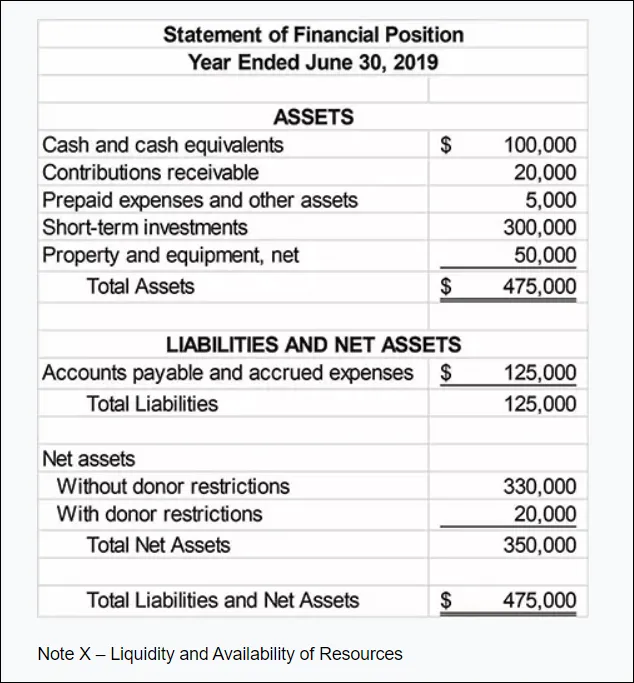

One of the foundational statements in any financial report is the Statement of Financial Position, often referred to as the Balance Sheet. This statement provides a snapshot of your organization’s assets (what you own), liabilities (what you owe), and net assets (the difference between assets and liabilities) at a specific point in time. For nonprofits, net assets are typically categorized as “with donor restrictions” or “without donor restrictions,” which is crucial for tracking funds designated for specific purposes by donors.

Equally important is the Statement of Activities, which is similar to an income statement in a for-profit entity. This report details your organization’s revenues, expenses, and changes in net assets over a period, such as a month or year. Revenues often include contributions, grants, program service fees, and investment income. Expenses are typically broken down by function (program services, management and general, fundraising) and sometimes by natural classification (salaries, rent, supplies). Understanding this statement helps assess your organization’s operational performance and financial sustainability.

The Statement of Cash Flows provides insight into how cash is being generated and used by your organization across three main activities: operating, investing, and financing. This statement is vital because it reveals your liquidity and solvency, showing whether you have enough cash to meet your short-term obligations and fund your operations. While the Statement of Activities shows profitability, the Statement of Cash Flows illustrates actual cash movement, which can sometimes tell a very different story.

Key Sections to Include in Your Monthly Report

Including these sections in your nonprofit monthly financial report template provides a comprehensive and detailed view that goes beyond the basic financial statements. It enables deeper analysis, supports accountability to donors, and empowers your board and leadership to make data-driven decisions that strengthen your mission.

Streamlining Your Reporting Process with the Right Tools

Creating accurate and timely financial reports monthly can be a daunting task for many nonprofit organizations, especially those with limited administrative staff or complex funding streams. However, with the right approach and the proper tools, this process can be streamlined, turning a potential headache into a powerful asset. Leveraging a dedicated nonprofit monthly financial report template is the first step toward achieving consistency and efficiency in your financial operations. This template acts as a standardized framework, ensuring that all necessary information is captured, presented clearly, and available for review promptly.

The benefits of standardizing your reporting are immense. It not only saves countless hours typically spent on formatting and data compilation but also significantly reduces the risk of errors. A consistent template means that anyone reviewing the reports, from board members to potential funders, can quickly understand the financial information without needing to re-familiarize themselves with different layouts each time. This clarity fosters greater confidence and trust in your organization’s financial management practices. Moreover, it allows for easier month-over-month and year-over-year comparisons, which are vital for identifying trends, measuring progress against budget, and making proactive financial adjustments.

When selecting or developing a nonprofit monthly financial report template, consider the various tools available. While simple spreadsheets like Excel or Google Sheets can be effective for smaller organizations, they require meticulous manual input and can be prone to errors if not managed carefully. For larger or growing nonprofits, dedicated accounting software (such as QuickBooks for Nonprofits, Sage Intacct, or NetSuite) offers robust features designed specifically for nonprofit financial management. These systems can automate data entry, generate reports with a few clicks, and provide advanced tracking capabilities for restricted funds and grant reporting, ultimately freeing up staff to focus on mission-critical activities.

Tips for Effective Template Implementation

A well-implemented template, whether spreadsheet-based or integrated with accounting software, transforms financial reporting from a chore into a strategic advantage, allowing your nonprofit to focus more resources on achieving its mission.

Implementing a robust system for your monthly financial reporting is more than just good practice; it is a foundational element for ensuring your nonprofit’s long-term health and ability to impact the community. By providing clear, consistent, and comprehensive financial information, you empower your board, reassure your donors, and guide your internal decision-making towards greater efficiency and effectiveness.

Investing time in developing or adapting a solid reporting framework will pay dividends by fostering transparency, accountability, and the strategic foresight needed to navigate challenges and seize opportunities. Your commitment to excellent financial stewardship directly strengthens your mission and enhances your capacity to make a lasting difference.