Embarking on a corporate acquisition is a monumental decision, often involving significant capital and strategic shifts. It’s a journey filled with potential, but also with inherent risks that demand meticulous scrutiny. Before shaking hands and signing on the dotted line, understanding every facet of the target company is paramount. This deep dive into a company’s past, present, and projected future is what we call due diligence.

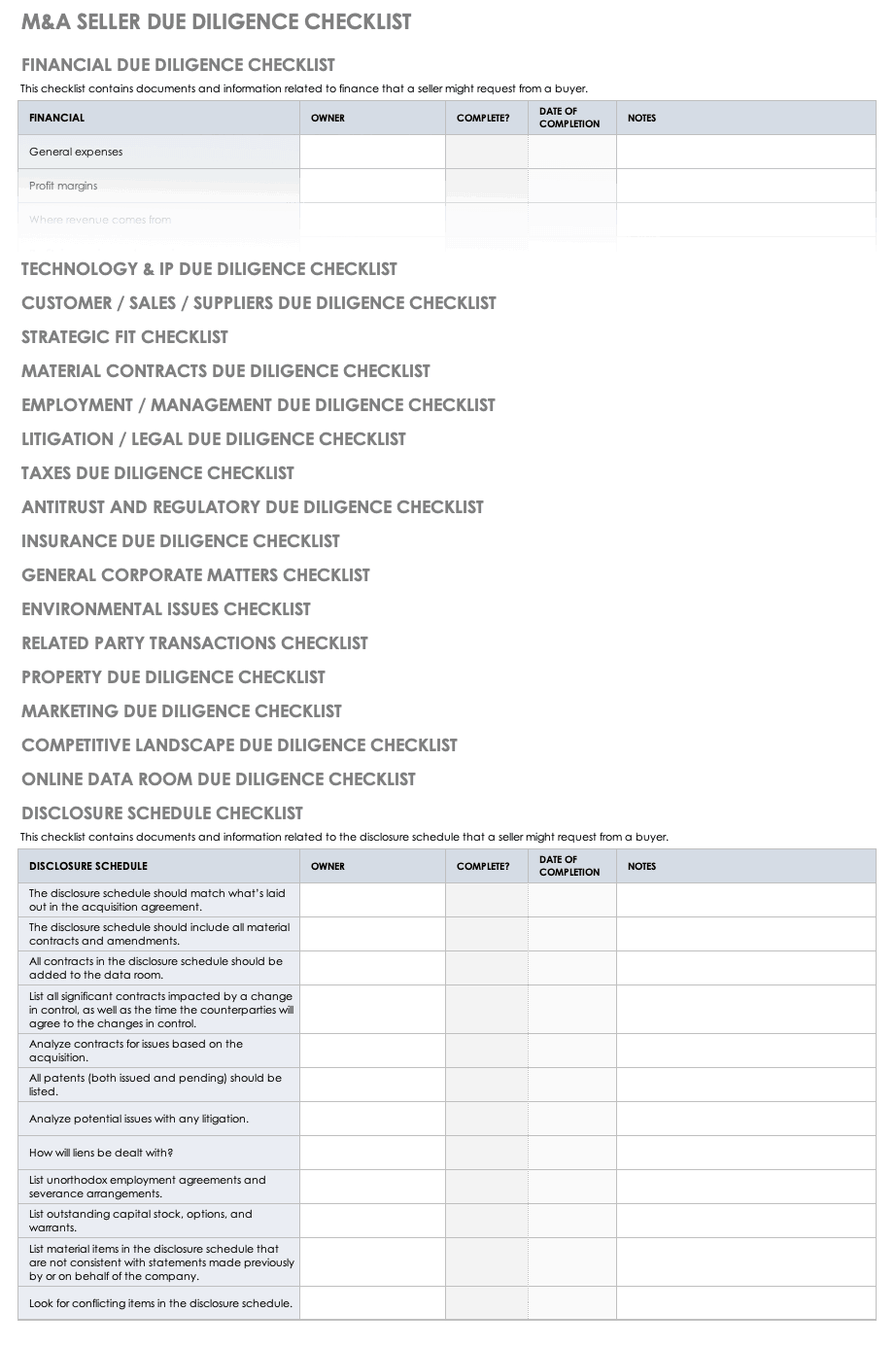

Without a structured approach, due diligence can quickly become an overwhelming sea of documents, interviews, and data points. This is where a well-crafted framework becomes indispensable. It helps streamline the process, ensures no critical area is overlooked, and ultimately provides a clear, comprehensive picture of the target’s value and potential liabilities. It transforms a complex investigation into a manageable, actionable process.

Our aim here is to explore the anatomy of an effective acquisition due diligence report template. We’ll walk you through the key sections, discuss how to tailor it for various scenarios, and highlight why having a robust template is not just a convenience but a strategic imperative for any successful merger or acquisition.

The Essential Elements of Your Acquisition Due Diligence Report Template

A truly effective acquisition due diligence report template acts as your roadmap, guiding you through every critical aspect of the target company. It’s designed to provide a holistic view, uncovering both opportunities and potential pitfalls, ensuring that your investment decision is informed and strategic. From financials to legal standing, operations to market positioning, each section contributes to a comprehensive understanding.

Financial Scrutiny

Delving into the financial health of a target company is often the first and most critical step. This involves a thorough examination of its historical performance and future projections to gauge its stability and growth potential. You’ll want to ensure that the numbers paint a consistent and realistic picture.

Legal and Regulatory Landscape

Understanding the legal obligations and potential liabilities of the target company is vital to mitigate future risks. This section ensures that the company operates within the bounds of the law and that there are no hidden legal surprises waiting post-acquisition. Clear title to assets, valid contracts, and an absence of major litigation are key indicators of a healthy legal standing.

Operational and Strategic Deep Dive

Beyond the numbers and legalities, understanding how the business actually runs is crucial. This includes everything from its core processes and supply chain to its human capital and technology infrastructure. It’s about assessing the efficiency, scalability, and overall resilience of the target’s operations, as well as its strategic alignment with your own business goals. A robust acquisition due diligence report template will allow for a thorough examination of these elements, highlighting synergies and potential integration challenges. Furthermore, assessing the company’s market position, customer base, and competitive landscape provides insights into its commercial viability and future growth prospects.

Tailoring Your Template for Specific Acquisitions

While a standardized acquisition due diligence report template provides an excellent foundation, it’s crucial to remember that no two acquisitions are exactly alike. Every target company operates in a unique environment, possesses distinct characteristics, and comes with its own set of opportunities and risks. Therefore, a one-size-fits-all approach to due diligence reports can be insufficient and potentially misleading.

Customizing your template allows you to focus resources on the most relevant areas, digging deeper where it matters most. For instance, acquiring a software company might require an intense focus on intellectual property, cybersecurity infrastructure, and research and development pipelines, whereas purchasing a manufacturing firm would necessitate a closer look at production facilities, supply chain robustness, and environmental compliance.

The flexibility to adapt your template ensures that the due diligence process remains efficient, targeted, and ultimately more effective in uncovering specific deal-breakers or value drivers. Considering the nuances of the transaction will significantly enhance the quality and relevance of your final report.

Having a meticulously prepared acquisition due diligence report template is more than just a checklist; it’s a strategic asset that empowers informed decision-making. It transforms a complex, multi-faceted investigation into a structured, manageable process, significantly reducing the likelihood of unforeseen issues arising post-acquisition and protecting your investment.

By systematically examining every critical aspect of a target company, you gain invaluable insights into its true value, its potential liabilities, and its alignment with your strategic objectives. This thoroughness is the cornerstone of successful M&A, enabling you to negotiate from a position of strength and confidently integrate new ventures into your organizational structure.