Navigating the complex world of real estate investment can feel a lot like trying to find your way through a dense fog without a compass. Opportunities often emerge quickly, but so do the risks, making swift yet informed decision-making absolutely crucial. Without a clear, organized approach to evaluating potential properties, it’s all too easy to overlook vital details, misinterpret market signals, or simply get overwhelmed by the sheer volume of information.

Many aspiring and even seasoned investors struggle with piecing together all the necessary data points into a coherent picture. You might have spreadsheets scattered across your desktop, handwritten notes from property tours, and market research articles bookmarked in various browsers. This fragmented approach not only consumes valuable time but also increases the likelihood of inconsistencies and errors, ultimately hindering your ability to confidently commit to or pass on an investment.

This is precisely where the power of structure comes into play. A well-designed real estate investment report template acts as your guide, transforming scattered data into a clear, concise, and actionable document. It standardizes your analysis, ensures you cover all critical aspects, and presents your findings in a way that is easy to understand, whether you are reviewing it yourself or presenting it to partners or lenders.

Why a Structured Report is Your Investment Superpower

Think about the last time you had to make a significant decision about a property. Were you able to instantly pull up all the relevant figures, market comparisons, and potential returns? For many, the answer is a resounding “not really.” The beauty of a structured report is that it brings all that critical information into one place, making your due diligence not just thorough, but also incredibly efficient. It’s about moving beyond gut feelings and into a realm of data-driven confidence.

A good template doesn’t just list numbers; it tells a story. It begins by outlining the core opportunity, then delves into the specifics, backing up every claim with verifiable data. This consistency means you can quickly compare different properties on an apples-to-apples basis, spotting patterns and red flags that might otherwise remain hidden. It forces you to ask the right questions and gather the necessary evidence before moving forward.

Beyond internal use, a professional and well-organized report is an invaluable tool for securing financing or attracting partners. Banks and private lenders are far more likely to take you seriously when you present a clear, comprehensive analysis of a potential investment. It demonstrates your professionalism, your understanding of the market, and your commitment to a sound investment strategy.

It also serves as a living document. As market conditions change or new information becomes available, you can easily update sections of your report, ensuring your analysis remains current. This iterative process is key to long-term success in real estate, allowing you to adapt and refine your strategy based on evolving circumstances.

Essential Sections to Include

To truly be effective, your real estate investment report template should cover a range of critical areas.

- Executive Summary: A concise overview of the opportunity, key financials, and the projected outcome. This is often the first and sometimes only section busy readers will initially review, so make it impactful.

- Property Description: Detailed information about the property itself, including address, property type, size, age, current condition, and any unique features.

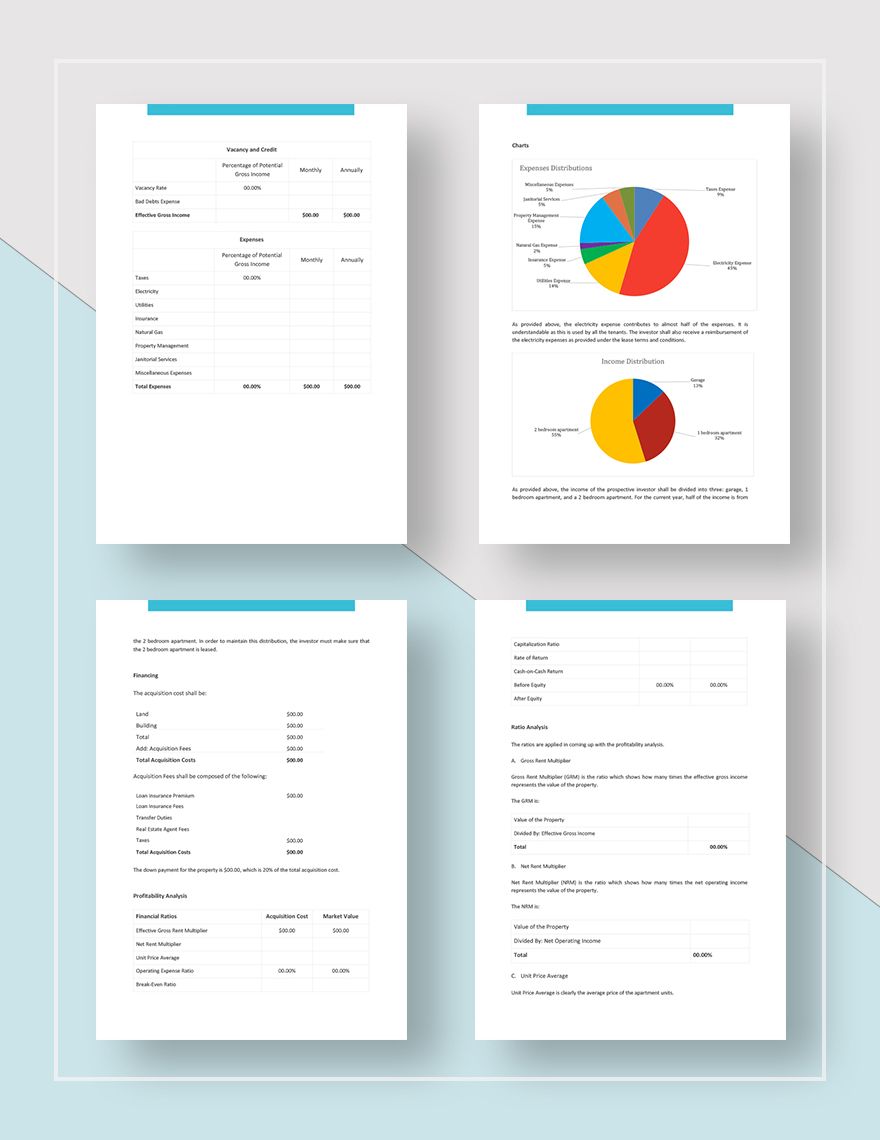

- Financial Analysis: The heart of your report, covering acquisition costs, projected rental income, operating expenses, cash flow projections, capitalization rate, return on investment (ROI), and internal rate of return (IRR).

- Market Analysis: An in-depth look at the local real estate market, including comparable sales and rentals, vacancy rates, demographic trends, and economic indicators affecting the area.

- Investment Strategy and Exit Plan: Your specific goals for the investment (e.g., long-term hold, flip, refinance) and a clear strategy for achieving those goals, including potential exit scenarios.

- Risk Assessment: Identification of potential risks, such as market downturns, unexpected repairs, or tenant issues, and proposed mitigation strategies.

Crafting Your Own Real Estate Investment Report Template

While there are many pre-made templates available, tailoring one to your specific investment strategy and property types is where you’ll find the most value. Starting with a basic framework and then customizing it allows you to build a tool that precisely meets your needs, whether you focus on single-family rentals, multi-family units, commercial spaces, or land development. Consider what metrics are most important for your decision-making and ensure those are prominently featured.

The process of building your own real estate investment report template can also be a valuable learning experience. It forces you to think deeply about every aspect of an investment, from the micro-level details of property condition to the macro-level trends of the broader economy. This hands-on approach builds a deeper understanding of real estate finance and market dynamics, enhancing your overall investment acumen.

Don’t feel like you need to start from scratch. Many powerful tools can help you generate comprehensive reports.

- Spreadsheet Software: Excel or Google Sheets remain indispensable for financial modeling, allowing for complex calculations and scenario analysis.

- CRM and Property Management Systems: These can help track property data, tenant information, and maintenance records, which feed directly into your operational expenses and cash flow projections.

- Dedicated Real Estate Investment Software: Specialized platforms often come with pre-built models and robust reporting features, streamlining the analysis process for various investment types.

- Presentation Tools: Platforms like PowerPoint or Google Slides can be used to create visually appealing summaries of your detailed reports for presentations.

Adopting a systematic approach to your real estate endeavors significantly enhances your chances of success. By consistently using a detailed report, you empower yourself to make intelligent choices, minimize risks, and articulate your vision with clarity and conviction. This dedication to thorough analysis fosters confidence, allowing you to seize promising opportunities with a firm grasp of all the facts. It’s about building a solid foundation for every investment, ensuring that each decision is a step towards achieving your financial objectives.