Running a business, whether it’s a bustling retail store, a cozy cafe, or a service-based operation, involves a multitude of daily tasks. Among the most critical, yet sometimes overlooked, is the meticulous handling of your daily financial transactions. Keeping track of every sale, refund, and payment can feel like a daunting task without a structured approach, especially when the day is packed with customer interactions and operational demands.

Without a clear system, you might find yourself grappling with discrepancies, struggling to balance the books, and even facing unnecessary stress when it comes to understanding your true financial position. Errors can easily creep in, leading to frustration, lost revenue, and a lack of confidence in your daily sales figures. This is where a simple yet powerful tool becomes indispensable for maintaining accuracy and peace of mind.

Imagine having a straightforward method to reconcile all your cash and card transactions, identify any overs or shorts, and get a clear snapshot of your daily performance. That’s precisely the power of an end of day cash register report template. It transforms a potentially chaotic closing process into an organized, efficient routine, ensuring you start each new business day on solid financial ground.

Why an End of Day Cash Register Report Template is Crucial for Your Business

Adopting a consistent end of day cash register report template is more than just a good practice; it’s a fundamental pillar for sound financial management. This essential document acts as your daily financial diary, capturing all the monetary ins and outs, and providing an undeniable record of your business’s financial heartbeat. Its primary role is to ensure that the physical cash and digital sales in your register perfectly match your recorded transactions, preventing those puzzling “where did that money go?” moments.

Beyond simple reconciliation, this report offers invaluable insights into your sales patterns. By diligently tracking daily sales data, you can identify peak selling times, understand customer purchasing habits, and even spot trends that might influence your inventory management and staffing decisions. It helps you move beyond guesswork and make data-driven choices for your business’s future.

Security is another significant benefit. A daily reporting system creates a layer of accountability for your staff. When employees know their cash drawer will be balanced and reported at the end of each shift, it significantly reduces the likelihood of internal theft or careless errors. It fosters an environment of trust and transparency, where everyone understands their responsibility in handling the business’s finances.

Furthermore, an accurate daily report simplifies your bookkeeping and tax preparation. Instead of scrambling at the end of the month or year, you’ll have a systematic record of all your transactions readily available. This not only saves time but also ensures you have all the necessary documentation for financial audits, providing peace of mind and demonstrating your commitment to good financial governance.

Ultimately, an effective end of day cash register report template empowers you with control. It helps you quickly identify and address issues, whether it’s a simple counting error or a more serious discrepancy, before they escalate. This proactive approach ensures the financial integrity of your business, allowing you to focus on growth and serving your customers with confidence.

Key Components of an Effective Template

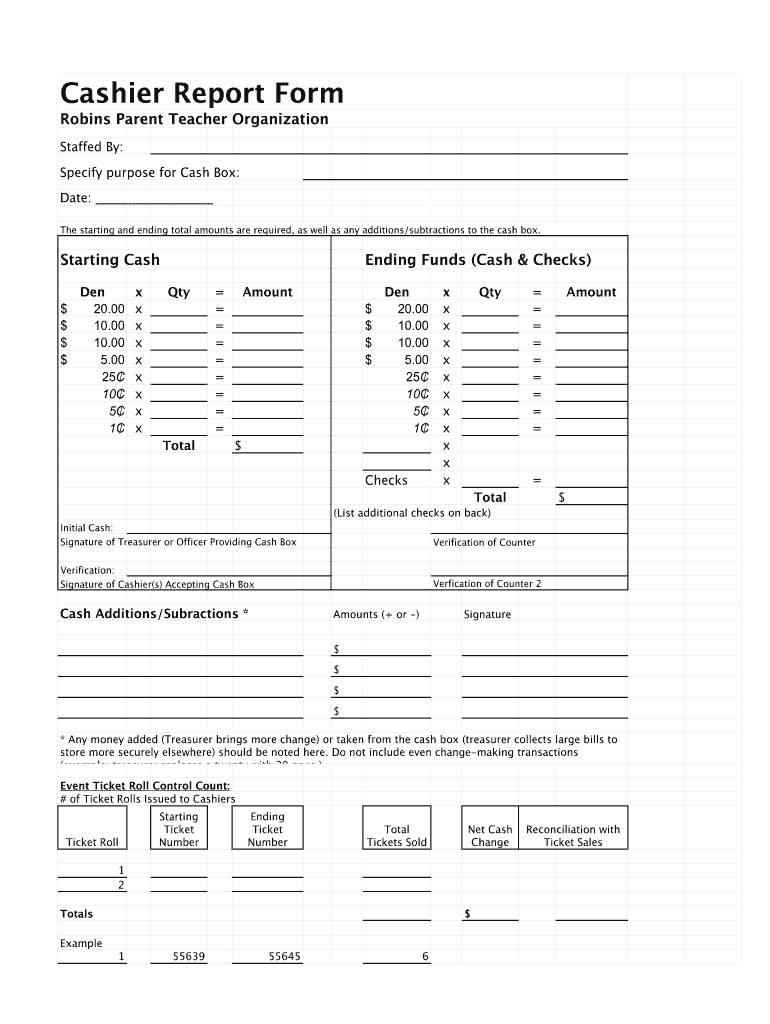

A well-designed template doesn’t need to be overly complicated, but it should include all the vital information necessary for a complete daily financial reconciliation. Here are the core elements you’ll want to incorporate:

- Date and Shift Information: Clearly mark the specific day and any relevant shift details (e.g., morning, evening, specific employee).

- Starting Cash Drawer Balance: The exact amount of cash in the drawer at the beginning of the shift or day, known as the float.

- Total Sales (Categorized): Break down sales by payment method, such as cash sales, credit/debit card sales, gift card redemptions, and any other payment types.

- Refunds and Voids: Document all returned items and cancelled transactions, including the reason and amount.

- Non-Sale Payouts: Record any money removed from the drawer for business expenses, like petty cash purchases or supplier payments.

- Ending Cash Drawer Count: The physical count of all cash in the drawer at the end of the day or shift.

- Calculated Expected Balance: This is your starting balance plus total cash sales minus cash refunds and payouts.

- Over/Short Discrepancy: The difference between your ending cash count and your calculated expected balance.

- Employee Signature Line: An area for the person performing the count to sign and date, indicating accountability.

Crafting and Implementing Your End of Day Reporting Process

Creating your own end of day cash register report template doesn’t have to be intimidating. Many businesses start with a simple spreadsheet or even a printed form that they’ve customized to fit their specific operational needs. The key is to design something that is intuitive for your staff to use and accurately captures the data that matters most to your business. Consider what payment methods you accept, any unique expenses you might pay out of the till, and the level of detail you need for your daily financial review.

Once you have your template, the next crucial step is implementation and training. Consistency is paramount for the system to be effective. Ensure every employee who handles the cash register is thoroughly trained on how to properly fill out the report, perform accurate cash counts, and understand the importance of meticulous record-keeping. Make it a part of your daily closing procedure, a non-negotiable step that ensures financial clarity and accountability. Regular review of these reports will also help you identify any recurring issues or training gaps.

Whether you opt for a digital solution within your point of sale system, a customizable spreadsheet, or a stack of printed forms, the benefits of a structured end of day reporting process are undeniable. It transforms what could be a source of daily stress into a streamlined, reassuring routine. This systematic approach ensures that you always have a clear and accurate picture of your daily revenue, making informed decisions about your business’s financial future easier than ever before.

Embracing an organized approach to your daily finances with a reliable reporting system can significantly reduce stress and improve the overall efficiency of your business operations. It’s an investment in accuracy, security, and a clearer financial future, providing a solid foundation upon which your business can thrive and grow. Start implementing yours today and experience the positive transformation it brings.