Running a small business is a thrilling adventure, filled with innovation, dedication, and sometimes, a little bit of financial mystery. Keeping tabs on where every dollar goes can feel like a monumental task, especially when you’re juggling so many other responsibilities. Yet, understanding your financial inflows and outflows isn’t just good practice; it’s absolutely crucial for sustainable growth and making smart, informed decisions.

Without a clear picture of your spending, it’s easy for expenses to quietly creep up, chipping away at your profits before you even realize it. You might be missing opportunities to save money, struggling to budget effectively for future projects, or even finding tax season more stressful than it needs to be. The good news is that getting a handle on your expenditures doesn’t have to be complicated or time-consuming.

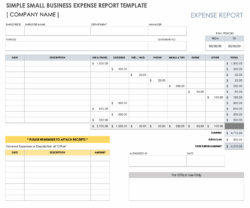

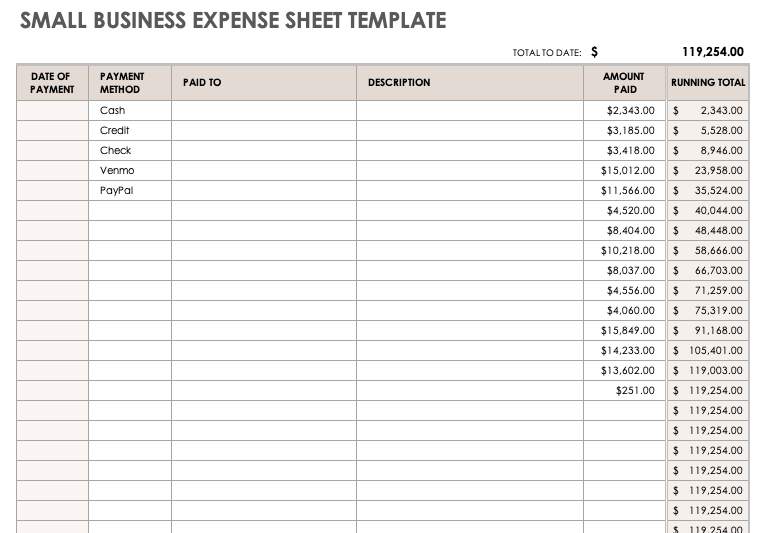

Imagine having a simple, straightforward tool that helps you track every penny, categorize your spending, and review your financial health at a glance each month. That’s precisely what a well-designed small business monthly expense report template can offer. It’s your secret weapon for transforming financial chaos into clarity, empowering you to manage your business’s money with confidence and precision.

Why a Monthly Expense Report Is Your Business’s Financial GPS

Think of your monthly expense report as the navigational system for your business’s finances. It doesn’t just tell you where you’ve been, but it also provides vital insights to help you plot your course forward. By meticulously tracking your expenses each month, you gain an unparalleled understanding of your operational costs, allowing you to identify trends, spot potential inefficiencies, and ultimately make more strategic financial decisions that impact your bottom line.

This regular review process is incredibly powerful. It helps you quickly pinpoint areas where you might be overspending, such as subscriptions you no longer use, or excessive office supply purchases. Conversely, it can highlight essential investments that are truly paying off, helping you justify continued allocation of resources to those successful areas. This level of detail empowers you to optimize your budget, ensuring every dollar is working as hard as possible for your business.

Moreover, consistent expense tracking simplifies tax preparation dramatically. Instead of scrambling at year-end to gather receipts and categorize transactions, your monthly reports provide an organized, ready-to-go record of all deductible expenses. This not only saves you time and stress but also helps ensure you claim every eligible deduction, potentially reducing your tax liability and keeping more money in your business.

Beyond budgeting and taxes, understanding your monthly expenses is fundamental to accurate cash flow forecasting. When you know what typically goes out the door each month, you can better anticipate future financial needs and avoid cash flow crunch situations. This proactive approach to financial management is a hallmark of successful small businesses, fostering stability and paving the way for sustainable growth and expansion.

A comprehensive small business monthly expense report template should capture all the necessary details to give you this complete financial picture. It’s more than just a list of numbers; it’s a narrative of your business’s spending habits.

Key Sections to Include in Your Report

- Date: The exact day the expense occurred.

- Vendor or Payee: Who you paid the money to.

- Description: A brief explanation of the expense, like “new printer ink” or “social media ad spend.”

- Category: Group expenses into logical types for easier analysis (e.g., Office Supplies, Marketing, Utilities).

- Payment Method: How you paid (e.g., credit card, bank transfer, cash).

- Amount: The precise cost of the expense.

- Notes: Any additional details, such as if it was a one-time purchase or related to a specific project.

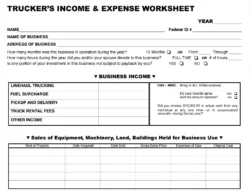

Essential Categories for Tracking

- Office Supplies and Equipment

- Rent and Utilities (electricity, internet, water)

- Marketing and Advertising (online ads, print materials)

- Software Subscriptions and IT Services

- Travel Expenses (fuel, public transport, accommodation)

- Professional Fees (accountant, lawyer, consultant)

- Salaries and Wages (if applicable)

- Insurance Premiums

- Loan Payments and Interest

Making Your Expense Report a Powerful Tool

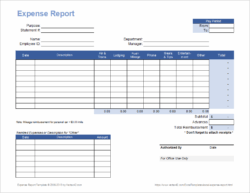

Having a small business monthly expense report template is only the first step; consistently using and analyzing it is where the real magic happens. Make it a routine to update your report regularly, perhaps weekly or bi-weekly, rather than trying to remember everything at the end of the month. This proactive approach ensures accuracy, reduces the burden of financial tasks, and keeps you perpetually informed about your business’s financial status.

Once your expenses are recorded, take the time to review them. Look for patterns: are certain categories consistently higher than anticipated? Are there seasonal fluctuations in your spending? This kind of analysis isn’t just about cutting costs; it’s about understanding the financial pulse of your business. It allows you to set more realistic budgets for the future, negotiate better deals with suppliers, and even identify opportunities to invest in areas that will bring the greatest return.

Leveraging tools like spreadsheets (Google Sheets or Excel) can make managing your expense report incredibly efficient. Many templates are readily available online, or you can create one tailored specifically to your business’s unique needs. The key is to find a system that is easy for you to maintain and provides the clarity you need to make informed financial decisions without feeling overwhelmed.

Embracing a systematic approach to tracking your business expenses is a game-changer. It removes the guesswork from your financial planning, giving you peace of mind and a clear pathway to achieving your business goals. When you understand exactly where your money is going, you’re better equipped to control it, allowing you to allocate resources more effectively and build a stronger, more resilient enterprise.

Ultimately, a detailed look at your monthly expenses empowers you to not just survive but thrive. It’s about building a solid financial foundation, making strategic moves with confidence, and ensuring your small business is on a steady trajectory toward long-term success and prosperity.