In today’s financial landscape, the spotlight on consumer protection has never been brighter. Firms are increasingly challenged to demonstrate not just compliance with regulations, but a genuine commitment to delivering good outcomes for their customers. This isn’t merely about ticking boxes; it’s about embedding a consumer-centric culture at every level of the organisation.

Understanding and acting upon the Consumer Duty principles requires a robust framework for oversight and accountability. While operational teams work diligently on implementation, the board carries the ultimate responsibility for ensuring these principles are upheld and that the firm consistently meets its obligations. Effective communication of performance, risks, and strategic initiatives to the board is therefore paramount.

This is where a well-structured approach to reporting becomes invaluable. Imagine having a clear, concise, and comprehensive document that distills complex information into actionable insights for your board members. Such a tool not only simplifies the reporting process but also elevates the quality of discussions, enabling more informed decision-making.

Why a Structured Board Report is Crucial for Consumer Duty

The Consumer Duty places significant emphasis on board-level oversight. Directors are expected to actively engage with how their firm is meeting its obligations, challenge existing practices, and ensure that the interests of consumers remain at the heart of every decision. Without a structured reporting mechanism, boards can struggle to gain a holistic view of the firm’s consumer duty performance, potentially overlooking emerging risks or areas requiring immediate attention.

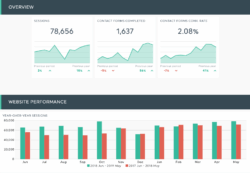

A well-designed report provides a consistent format for presenting key data, metrics, and narrative insights. This consistency allows board members to easily track progress over time, compare performance against benchmarks, and identify trends. It transforms what could be a disparate collection of information into a cohesive story about the firm’s dedication to its customers, helping to foster a culture of transparency and proactive management. It’s about moving beyond anecdotal evidence to data-driven insights.

Moreover, a structured board report acts as a powerful evidence base. In an environment where regulators are keen to see demonstrable proof of compliance and good consumer outcomes, having clear records of what the board is reviewing and acting upon is invaluable. It showcases the firm’s diligence and commitment, reinforcing trust with both regulators and consumers alike. When the board can articulate precisely how they are monitoring Consumer Duty, it speaks volumes about the firm’s governance.

A robust reporting framework also facilitates more meaningful dialogue during board meetings. Instead of spending valuable time sifting through unorganised data, board members can immediately focus on strategic implications, challenging assumptions, and proposing solutions. This efficiency ensures that discussions are productive and that critical decisions regarding consumer welfare are made promptly and effectively.

Ultimately, having a comprehensive consumer duty board report template is not just a regulatory necessity; it’s a strategic advantage. It empowers your board to effectively champion consumer interests, navigate complex regulatory landscapes, and build long-term trust with your customer base. It ensures that the firm’s purpose and values are tangibly linked to its operational performance.

Key Sections to Include in Your Consumer Duty Report

- Executive Summary: A concise overview of key findings, risks, and recommended actions.

- Consumer Outcomes Overview: Summary of how the firm is delivering good outcomes across products, services, and the customer journey.

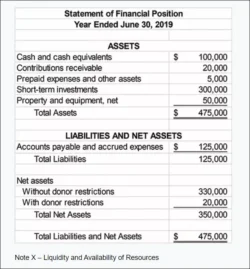

- Data and Metrics: Key performance indicators related to consumer outcomes, such as complaints data, product suitability, and customer satisfaction scores.

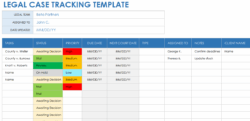

- Risk Assessment and Mitigating Actions: Identification of current and emerging consumer duty risks and the measures being taken to address them.

- Complaints Analysis: Detailed breakdown of complaint trends, root causes, and remedial actions.

- Training and Culture: Updates on staff training, cultural initiatives, and how consumer duty is embedded within the firm.

- Future Plans and Recommendations: Proposed strategic initiatives, policy changes, and areas for improvement.

Crafting Your Own Effective Consumer Duty Board Report Template

Developing a strong consumer duty board report template tailored to your specific organisation is a journey of refinement. It begins with understanding the core requirements of the Consumer Duty itself and translating those into measurable and reportable elements. Consider what your board truly needs to know to fulfill its oversight responsibilities, focusing on outcomes rather than just processes. Engaging board members early in the development process can ensure the template meets their expectations and provides them with the right level of detail.

The beauty of a template lies in its adaptability. While it provides a consistent structure, it should never be a rigid straitjacket. Firms operate in diverse markets, offer different products, and serve various customer segments, meaning that a one-size-fits-all approach is rarely effective. Your template should be flexible enough to accommodate updates to regulatory guidance, changes in your business model, or new consumer insights, allowing for continuous improvement based on feedback and evolving needs.

When creating or customising your template, think about the data sources that feed into it. Are these sources reliable? Are the metrics clearly defined and consistently measured? A robust template is only as good as the information it presents. Consider incorporating sections for qualitative insights alongside quantitative data to provide a richer, more nuanced picture of your firm’s consumer duty performance. This holistic view helps the board grasp the ‘why’ behind the numbers.

Regular review and iteration of your consumer duty board report template are essential. As your firm evolves and the regulatory landscape shifts, so too should your reporting. Make it a standing agenda item to review the effectiveness of your template periodically, gathering feedback from board members and operational teams. This iterative process ensures that your reporting remains relevant, impactful, and continues to serve as a cornerstone of your firm’s commitment to its consumers.

Through diligent application of a robust reporting framework, organisations can ensure that consumer protection is not merely a compliance exercise but a fundamental pillar of their business strategy. It fosters a proactive approach to identifying and addressing potential harms, ultimately building stronger, more trusted relationships with customers. By consistently providing a clear picture of consumer outcomes, firms can drive continuous improvement and reinforce their commitment to doing the right thing.