Navigating the world of employee benefits can feel overwhelming, especially when you are trying to secure the best health coverage for your team. That is where a solid group health insurance proposal template comes into play, acting as your secret weapon for clear, compelling presentations. It provides a structured framework that guides you through the complexities, ensuring all vital information is conveyed effectively and professionally.

Imagine trying to gather all the necessary details, present them professionally, and articulate the value of a specific plan without a structured approach. It is a recipe for missed opportunities and potential confusion. A well-crafted proposal is not just about listing features; it is about telling a story that resonates with decision-makers, highlighting the true benefits and how they align with a company’s goals and employee needs.

Whether you are an insurance broker trying to win new clients or a business owner evaluating options, understanding the components of an effective proposal is crucial. This article will guide you through building a proposal that stands out, speaks volumes, and ultimately helps secure better health outcomes for your group.

Crafting a Winning Group Health Insurance Proposal

When you are presenting a group health insurance plan, you are not just offering a product; you are offering peace of mind, a valuable employee benefit, and a smart investment in a company’s human capital. A winning proposal needs to reflect this profound value, going beyond mere cost outlines to paint a comprehensive picture of the advantages and solutions provided.

The key to success often lies in tailoring your proposal to the specific needs and challenges of the client. Avoid a one-size-fits-all approach. Take the time to understand their company culture, budget constraints, current benefits, and employee demographics. This preliminary research forms the bedrock of a truly impactful proposal, allowing you to present solutions that are genuinely relevant.

Every robust proposal should include several fundamental sections. Think of it as a journey for the reader, guiding them from understanding their current situation to envisioning a better future with your proposed plan. It typically starts with a strong executive summary and moves into detailed plan options, financial considerations, and implementation strategies.

The Executive Summary: Your First Impression

This is arguably the most critical part. It should be a concise, compelling overview that highlights the client’s current situation, the key challenges you are addressing, and the primary benefits of your proposed solution. It needs to grab attention and make the reader want to delve deeper into the details. Think of it as an elevator pitch for your entire proposal, articulating the core value proposition upfront.

Understanding Plan Options and Benefits

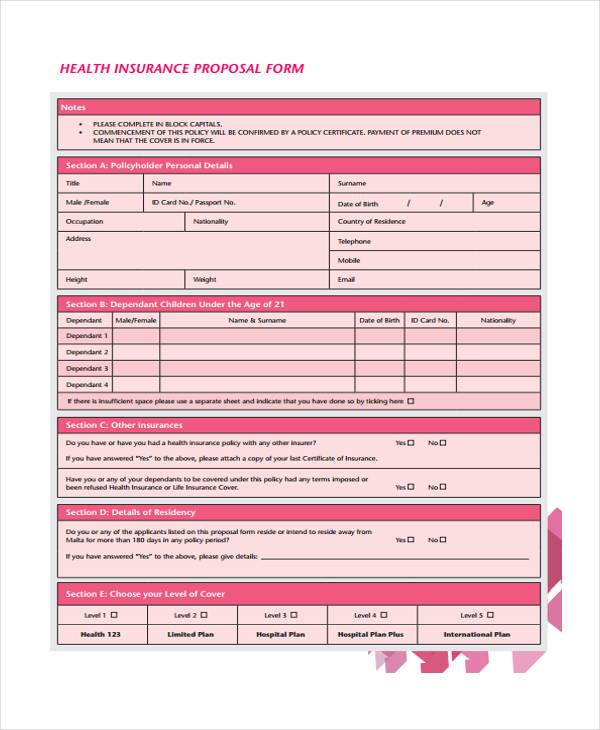

Following the summary, you will want to clearly outline the various plan options available. This section is not just about listing deductibles and co-pays. It is about explaining the tangible benefits each plan offers to employees, such as access to specific networks, wellness programs, mental health support, and comprehensive prescription drug coverage. Use clear language, avoiding jargon where possible, or explaining it thoroughly when necessary to ensure complete understanding.

The Investment and Value Proposition

Naturally, the cost is a significant factor. Present the pricing structure transparently, breaking down employer and employee contributions. But do not just present numbers; articulate the value proposition. How does this plan improve employee retention, boost morale, or contribute to a healthier workforce? Connect the investment to tangible business outcomes, demonstrating how the benefits outweigh the costs in the long run.

Finally, conclude this section with a clear call to action. What do you want the client to do next? Schedule a follow-up meeting, ask specific questions, or proceed with enrollment? Make the next steps easy to understand and follow, paving the way for a smooth transition to their new group health insurance plan and securing their commitment.

Why a Template is Your Best Friend

Creating a comprehensive group health insurance proposal from scratch every time can be incredibly time-consuming and prone to inconsistencies. This is where leveraging a well-designed group health insurance proposal template becomes an invaluable asset for any professional dealing with employee benefits. It streamlines the entire process, allowing you to focus on customization rather than basic formatting.

A template ensures consistency in your branding, messaging, and overall presentation. This level of professionalism instills confidence in your clients. They see a polished, organized document that reflects positively on your attention to detail and expertise. It also helps prevent overlooked sections or critical information, ensuring every proposal maintains a high standard.

By providing a ready-made structure, a template significantly cuts down on the time required to draft proposals. You can quickly plug in client-specific details, plan options, and pricing, rather than building the framework from scratch. This efficiency allows you to spend more time on researching client needs, fine-tuning solutions, and building relationships, which are ultimately more impactful activities.

Here are some key sections commonly found in an effective template:

- Client Introduction and Needs Assessment

- Executive Summary of Proposed Solution

- Detailed Plan Options and Benefits Comparison

- Financial Investment and Employer Contributions

- Implementation Timeline and Support Services

- About Us/Why Choose Us

- Call to Action and Next Steps

Utilizing a robust group health insurance proposal template provides a clear roadmap, ensuring all essential elements are covered and presented in a logical flow. It truly elevates your proposal from a mere document to a persuasive tool.

Ultimately, a thoughtfully constructed group health insurance proposal is more than just paperwork; it is a powerful communication tool. It reflects your understanding of a client’s needs, showcases your expertise, and articulates the tangible benefits of the health plans you are presenting. Investing time in crafting a superior proposal pays dividends in client satisfaction and successful partnerships.

By focusing on clarity, customization, and a strong value proposition, you are not just securing a deal; you are helping businesses provide essential care for their employees, fostering a healthier, more productive workforce for years to come.