Running a non profit organization is a deeply rewarding endeavor, focused on making a positive impact in the world. However, alongside the passion for your mission comes the crucial responsibility of sound financial management. Transparency and accountability are not just good practices; they are fundamental pillars that build trust with your donors, volunteers, and the community you serve. Ensuring everyone involved understands the financial health of your organization is paramount for sustained success and growth.

The treasurer plays a vital role in this financial stewardship, acting as the guardian of the organization’s funds. Their responsibility extends beyond simply managing money; it includes clearly communicating the financial status to the board of directors, members, and sometimes even the public. This communication needs to be accurate, easy to understand, and presented in a way that highlights key financial trends and positions, allowing informed decisions to be made for the future.

However, preparing these reports can often feel like a daunting task, especially for busy volunteers or staff members. This is where having a reliable non profit treasurer report template becomes an absolute game-changer. It provides a structured framework, ensuring all essential information is included, saving countless hours, and helping to maintain consistency and professionalism in your financial reporting efforts.

Crafting a Comprehensive Treasurer Report: Essential Components

A well-structured treasurer report serves as a financial snapshot, giving your board and stakeholders a clear picture of your organization’s economic health during a specific period. It should not just be a list of numbers, but rather a narrative supported by data that tells the story of your financial activities. The goal is to provide enough detail for informed decisions without overwhelming the reader with unnecessary complexity.

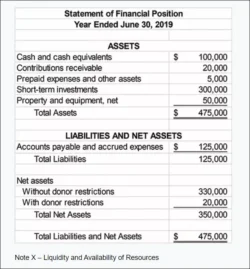

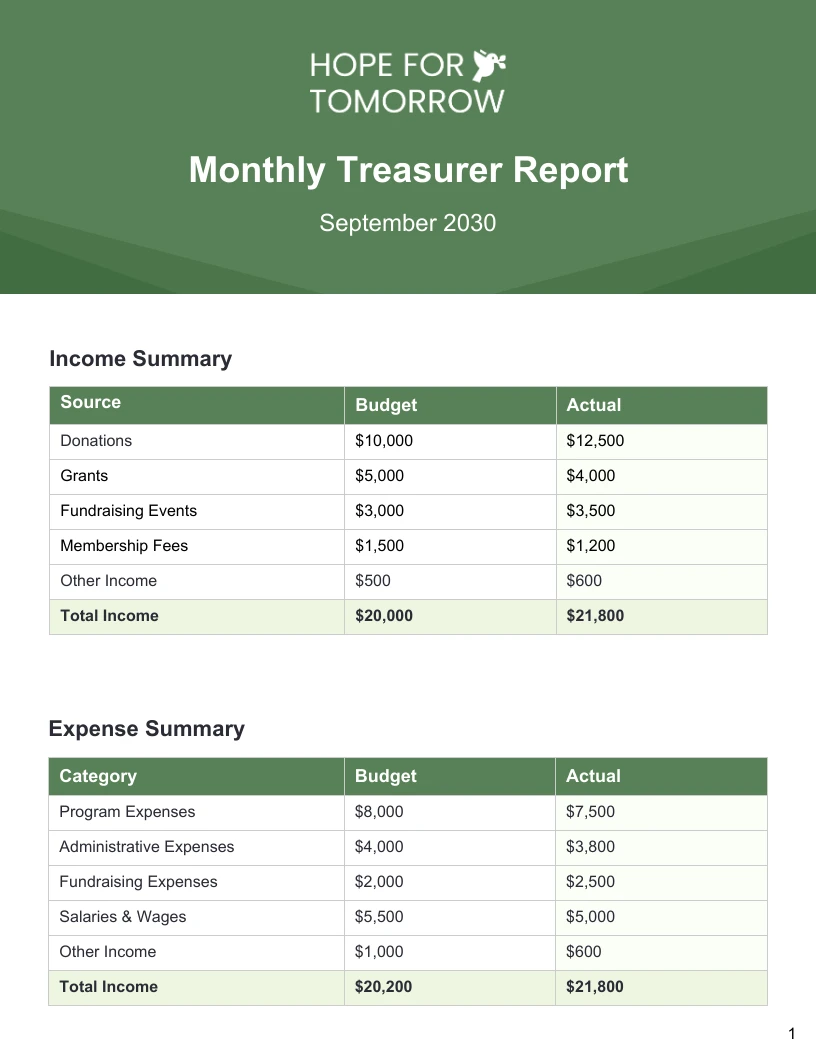

Typically, a robust treasurer report will start with an opening balance, indicating the financial position at the beginning of the reporting period. This is followed by a detailed breakdown of all income received and all expenses incurred. The report culminates in a closing balance, reflecting the organization’s financial standing at the end of the period, along with a clear indication of net profit or loss.

Understanding Your Income Sources

Detailing your income is crucial for showcasing how your non profit generates the resources needed to fulfill its mission. This section should clearly categorize where funds are coming from. Think about the different streams that fuel your operations.

For instance, your income might include:

- Individual donations

- Corporate sponsorships

- Grants from foundations or government bodies

- Fundraising event proceeds

- Membership fees

- Program service fees

- Investment income

Each category should be clearly labeled, and the amounts received within the reporting period should be accurately listed. This level of detail helps stakeholders understand the diversity and stability of your funding.

Tracking Every Penny: Expense Categories

Just as important as knowing where money comes from is understanding where it goes. The expense section of your treasurer report needs to be equally detailed and categorized. This demonstrates responsible spending and ensures that funds are being allocated in line with the organization’s mission and budget.

Common expense categories might include:

- Program expenses (costs directly related to delivering your services)

- Administrative expenses (overhead like rent, utilities, office supplies)

- Fundraising expenses (costs associated with generating income)

- Salaries and benefits

- Insurance

- Professional fees

Providing these clear categories allows for easy comparison against your budget and helps identify areas where spending might need to be adjusted or analyzed further. It paints a clear picture of operational efficiency.

Beyond the raw numbers, a compelling treasurer report often includes a brief narrative. This is your opportunity to highlight significant financial achievements, explain any major variances from the budget, or discuss important financial trends that might impact the organization in the future. It transforms the data into actionable insights for the board.

The Unsung Hero: How a Non Profit Treasurer Report Template Simplifies Financial Management

Embracing a standardized non profit treasurer report template is one of the most effective steps an organization can take towards simplifying its financial reporting. It’s more than just a pre-formatted document; it’s a tool for consistency, accuracy, and efficiency that benefits everyone involved, from the treasurer to the board of directors.

Imagine the peace of mind knowing that every month or quarter, your financial report will follow the same logical structure, ensuring no critical piece of information is ever overlooked. This consistency is invaluable for tracking trends over time, making comparative analysis far simpler, and presenting a professional image to all stakeholders. It reduces the likelihood of errors and omissions, which can save your organization from potential headaches down the line.

Here are some key advantages of using a reliable template:

- Time Savings: Drastically cuts down on preparation time, allowing treasurers to focus on analysis rather than formatting.

- Ensured Inclusivity: Guarantees that all necessary financial data points are covered in each report.

- Professional Presentation: Delivers a consistent and polished look, enhancing credibility.

- Easier Onboarding: Simplifies the transition process for new treasurers or board members.

- Improved Clarity: Promotes better understanding of financial information among non-finance professionals.

- Compliance Support: Helps ensure readiness for audits and adherence to reporting standards.

Ultimately, by leveraging a well-designed template, treasurers are empowered to shift their focus from the tedious task of data compilation to providing valuable financial insights and strategic recommendations. This elevated level of financial management directly supports the organization’s mission, allowing it to operate with greater transparency and effectiveness.

Robust financial reporting is the bedrock of a thriving non profit, fostering donor confidence and enabling strategic decision-making. It ensures that every dollar received and spent is accounted for, aligning with the organization’s goals and demonstrating a commitment to responsible stewardship. This commitment is vital for long-term sustainability and impact.

Adopting a comprehensive non profit treasurer report template is a smart and practical step toward achieving financial clarity and operational excellence. It streamlines what can often be a complex process, allowing your organization to remain focused on its core mission while maintaining impeccable financial integrity.