Venturing out as a self-employed individual brings a unique blend of freedom and responsibility. You are your own boss, your own team, and often, your own accountant. While the liberation of setting your own hours and pursuing your passions is exhilarating, managing the financial aspects of your business can quickly become overwhelming without proper systems in place. From tracking income to managing expenses and preparing for tax season, the administrative burden can sometimes overshadow the creative work.

One of the most critical aspects of maintaining a healthy self-employed business is meticulous record-keeping. This isn’t just about satisfying the tax authorities; it’s about gaining a clear understanding of your financial health, identifying trends, and making informed decisions for future growth. Without a structured way to track what you earn and what you spend, you might miss opportunities, overpay taxes, or even find yourself in a tricky situation during an audit.

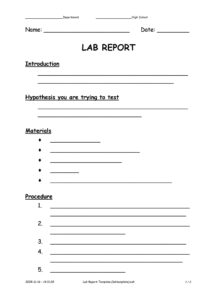

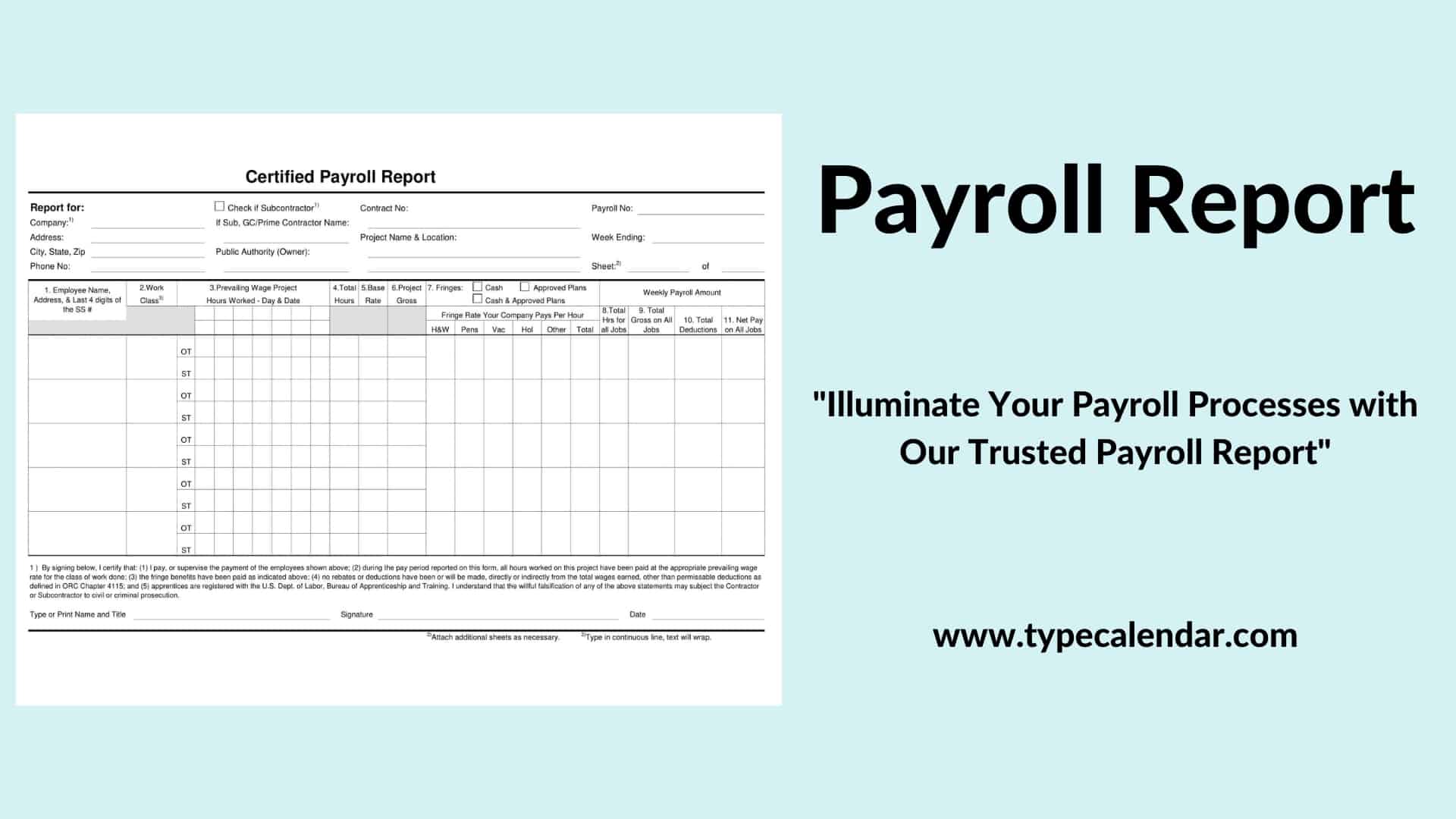

This is where a dedicated tool can make all the difference. Imagine having a straightforward, easy-to-use system that consolidates your financial activity into one clear overview. That’s precisely the role a well-designed self employed payroll report template plays. It simplifies the complex task of financial tracking, allowing you to focus more on your core business activities and less on the daunting paperwork.

The Indispensable Role of a Structured Financial Overview

For anyone working independently, whether you’re a freelancer, a contractor, or a small business owner without employees, maintaining a transparent record of your income and outflows is paramount. A comprehensive reporting system, often facilitated by a dedicated template, provides a snapshot of your financial performance over a given period. It’s not just a collection of numbers; it’s a narrative of your business’s journey, highlighting success and areas that might need attention.

One of the most immediate benefits of using a clear template is its impact on tax preparation. As a self-employed individual, you’re responsible for paying self-employment taxes, which typically involve quarterly estimated payments. A well-kept report ensures you have an accurate picture of your taxable income throughout the year, preventing last-minute scrambles and potential penalties. It allows you to easily identify deductible expenses, maximizing your savings and ensuring you only pay what you legitimately owe.

Beyond taxes, a detailed report offers invaluable insights into your profitability. By tracking your gross income against all associated business expenses, you can determine your true net earnings. This clarity helps you understand which services or products are most lucrative, whether your pricing strategy is effective, and where you might be able to cut unnecessary costs. It’s a powerful tool for strategic planning, enabling you to make data-driven decisions about your rates, investments, and overall business direction.

Furthermore, maintaining an organized financial record demonstrates professionalism and reliability. Should you ever need to apply for a loan, secure financing, or even just present your financial standing to a potential client or partner, having a coherent and easily understandable report will be a significant advantage. It provides tangible evidence of your business’s stability and growth, instilling confidence in your financial management capabilities.

In essence, a self employed payroll report template transforms a daunting administrative task into a manageable and insightful process. It brings order to the financial chaos, empowering you with the knowledge needed to steer your business toward sustained success and financial security.

Key Elements Found in an Effective Template

- Date of Transaction: Essential for chronological tracking and financial period reporting.

- Description of Income/Expense: A brief note explaining what the transaction was for (e.g., “Client Project X,” “Software Subscription”).

- Client/Payer: Who paid you or who you paid, important for invoicing and reconciliation.

- Income Amount: The money received before any deductions.

- Expense Category: Clearly defined categories (e.g., supplies, marketing, travel, professional development) for easy analysis and tax deduction.

- Expense Amount: The money spent.

- Net Income/Profit: Automatically calculated (Income – Expenses) to show your take-home amount for a given period or transaction.

- Notes/Comments: Any additional details relevant to the transaction.

Where to Find or Create Your Template

- Spreadsheet Software: Programs like Microsoft Excel, Google Sheets, or Apple Numbers are excellent for creating customized templates from scratch or adapting existing ones. They offer flexibility and powerful calculation features.

- Accounting Software: Many popular accounting platforms (e.g., QuickBooks Self-Employed, FreshBooks, Wave) include built-in reporting features that function much like a template, automating data entry and categorization.

- Online Resources: A quick search will yield numerous free or paid downloadable templates specifically designed for self-employed individuals, often available in various formats.

Maximizing the Value of Your Financial Reporting

Simply having a template isn’t enough; the true power comes from consistently using and engaging with it. Make it a habit to update your report regularly, whether it’s weekly, bi-weekly, or monthly. This prevents a mountain of data entry from accumulating at the end of a quarter or year, ensuring that your records remain accurate and manageable. Regular updates also mean you have up-to-date financial insights at your fingertips whenever you need them.

Consider integrating your payroll reporting with other financial tools you might be using. For example, if you use a separate tool for expense tracking, ensure that data can be easily transferred or synchronized to avoid redundant entry. Linking your business bank account or credit card to certain accounting software can even automate much of this process, saving you valuable time and reducing the risk of manual errors. The goal is to create a seamless financial ecosystem that supports your business without adding unnecessary complexity.

Finally, don’t just fill out the report and forget it. Dedicate time to review your financial summary periodically. Look for patterns in your income and expenses. Are there months where income spikes or dips? Are certain expenses higher than expected? This regular review process isn’t just about compliance; it’s about understanding the pulse of your business. It allows you to anticipate future financial needs, adjust your strategies, and ultimately, make more proactive and informed decisions for your self-employed venture.

Embracing effective financial record-keeping is not merely an obligation; it is a fundamental pillar of sustainable self-employment. By transforming a potentially daunting task into a structured and routine activity, you unlock a clearer understanding of your business’s health and trajectory. This clarity empowers you to make smarter choices, ensuring your hard work translates into tangible success and financial peace of mind.

When your financial house is in order, you can channel more energy into your passions and less into administrative worries. Investing time upfront in setting up a reliable system, such as leveraging a comprehensive payroll report, will pay dividends, allowing you to focus on what you do best and confidently navigate the exciting journey of being your own boss.