Navigating the world of finance, renting, or even certain employment opportunities often involves a crucial step: checking someone’s credit history. For individuals or businesses needing to assess financial responsibility, whether for a potential tenant, a loan applicant, or even a prospective employee, understanding their creditworthiness is paramount. This process, however, isn’t a free-for-all; it requires explicit permission from the individual whose report is being accessed.

The necessity for this permission is rooted in consumer protection laws designed to safeguard personal financial information. Without proper authorization, accessing someone’s credit report is not only unethical but also illegal, carrying significant penalties. Therefore, having a clear, concise, and legally compliant method to obtain this consent is not just good practice, it’s essential for anyone involved in these types of evaluations.

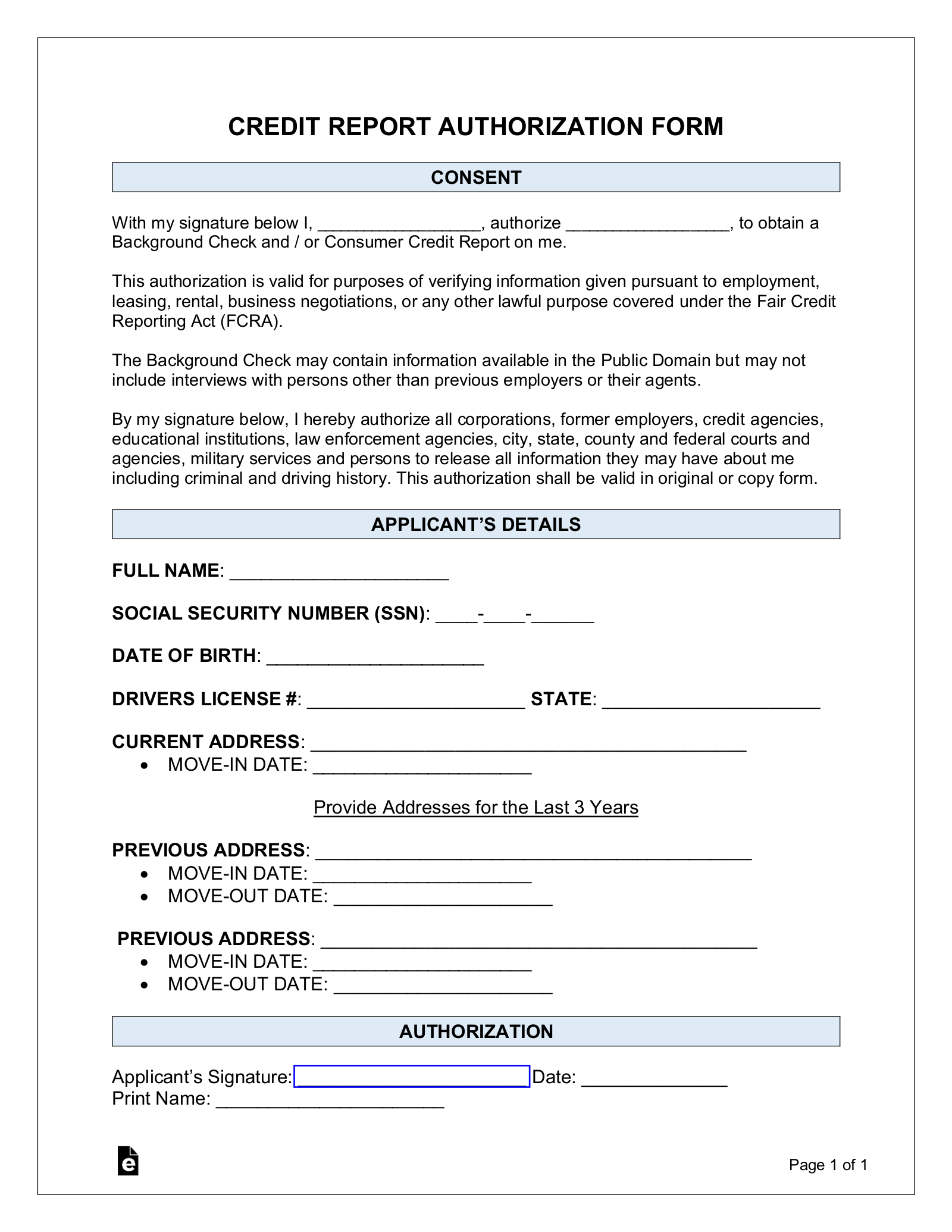

This is precisely where a reliable authorization to pull credit report template becomes an invaluable tool. It provides a standardized framework that ensures all necessary legal requirements are met, giving peace of mind to both the party requesting the report and the individual granting permission. Utilizing such a template streamlines the process, minimizes misunderstandings, and maintains transparency, making an often sensitive procedure much smoother.

Understanding the Importance of a Credit Report Authorization

When you consider the sensitive nature of financial data, it quickly becomes clear why an authorization to access a credit report is not merely a formality but a critical legal and ethical safeguard. The Fair Credit Reporting Act (FCRA) in the United States, for example, dictates strict rules about who can access your credit information and for what purpose. Simply put, you cannot randomly pull someone’s credit report without their explicit, written consent, unless you have a permissible purpose defined by law, which still often implies consent for specific actions like applying for a loan.

This authorization serves as a formal agreement, demonstrating that the individual understands and agrees to have their financial history reviewed. It provides a clear audit trail and protects the party requesting the report from legal challenges, ensuring they are operating within the bounds of the law. Without this vital document, any attempt to access someone’s credit file would be a breach of privacy and a violation of federal regulations, potentially leading to significant fines and reputational damage.

For those evaluating financial risk, such as landlords or lenders, the credit report offers a detailed snapshot of an individual’s financial behavior. It reveals payment history, outstanding debts, bankruptcies, and other factors that paint a picture of their reliability. This information is invaluable for making informed decisions, reducing the risk of default or missed payments. However, gaining access to this insightful data must always begin with the proper authorization.

It is also important to distinguish between “hard” and “soft” inquiries. A hard inquiry occurs when a lender or financial institution checks your credit report, typically when you apply for new credit, a mortgage, or a significant loan. These inquiries can slightly lower your credit score and remain on your report for two years. A soft inquiry, on the other hand, might occur when you check your own credit, or when a potential employer or landlord performs a background check. Soft inquiries do not affect your credit score. The authorization form should ideally clarify which type of inquiry will be made.

Ultimately, a clear authorization to pull credit report template protects both parties involved. The individual knows exactly what information is being accessed and why, maintaining their right to privacy, while the requesting party gains the necessary insights legally and ethically. It fosters trust and transparency, setting the foundation for a positive relationship, whether it’s between a landlord and tenant, or a lender and borrower.

Key Elements to Include in Your Authorization Form

To ensure your authorization form is comprehensive and legally sound, it should clearly specify several critical pieces of information. Omitting any of these could invalidate the consent or lead to complications down the line. Here are the essential components:

- Applicant’s Full Legal Name and Contact Information: Including current address, phone number, and email.

- Social Security Number (SSN): This is crucial for accurate identification, though it should be handled with utmost care due to its sensitive nature.

- Date of Birth: Further aids in verifying identity and differentiating individuals with similar names.

- Purpose of the Credit Pull: Clearly state why the report is being requested (e.g., “for rental application,” “for loan pre-approval,” “for employment background check”).

- Signature of Applicant: This signifies explicit consent.

- Date of Authorization: Records when permission was granted, establishing a clear timeline.

- Consent to Specific Credit Bureaus: While not always mandatory, specifying which credit bureaus (Experian, Equifax, TransUnion) may be accessed adds clarity.

- A Statement Acknowledging Understanding: The applicant should confirm they understand the implications of the credit pull, including whether it’s a hard or soft inquiry.

Each of these elements serves a vital function in creating a robust and compliant authorization document. They leave no room for ambiguity, ensuring that the process is transparent and that all parties are protected under the relevant consumer protection laws.

Who Benefits from an Authorization to Pull Credit Report Template?

The utility of a well-designed authorization to pull credit report template extends across various scenarios and benefits numerous parties. Primarily, it offers immense value to those who routinely need to assess an individual’s financial background for legitimate business purposes. Landlords, for instance, are among the most frequent users of such templates. Before entrusting their property to a new tenant, they need assurance that the individual has a history of financial responsibility, is likely to pay rent on time, and won’t accumulate significant debt that could jeopardize their ability to meet lease obligations.

Similarly, financial institutions and lenders rely heavily on credit reports. Whether it is for a mortgage, an auto loan, or a new credit card, the lender must gauge the applicant’s risk profile. An accurate credit report, accessed with proper authorization, allows them to make informed decisions about interest rates, loan terms, and overall approval. The template ensures that this crucial data acquisition is done lawfully and efficiently, forming the backbone of their underwriting process.

Even in some employment contexts, particularly for positions that involve handling money, sensitive data, or high levels of trust, employers may require a credit check. This helps them assess a candidate’s reliability and integrity. The authorization template facilitates this vetting process by providing a clear, consent-based pathway to obtain the necessary financial background information, always within legal boundaries and respecting privacy. The template also simplifies things for the individual granting permission, ensuring they are fully aware of what information is being shared and for what specific purpose, promoting transparency and trust.

The parties who significantly benefit from using an authorization to pull credit report template include:

- Landlords seeking reliable tenants.

- Lenders evaluating loan applicants.

- Employers (for certain roles) conducting background checks.

- Service providers requiring creditworthiness for contracts.

- Individuals granting permission, ensuring their rights are protected and the process is transparent.

In essence, a standardized template provides a clear, legally compliant bridge between the need for financial information and the right to privacy. It ensures that critical decisions, from housing to employment to lending, are made on the basis of accurate and ethically obtained data, benefiting everyone involved in the transaction.

Crafting an effective authorization to access credit information is more than just filling out a form; it is about establishing trust and ensuring legal compliance. The diligence in using a clear, comprehensive document protects both the requester and the individual, fostering a transparent environment for important life and business decisions. It underscores the respect for privacy while acknowledging the legitimate need for financial assessment in various contexts.

Therefore, for anyone involved in a transaction that requires a review of financial history, the strategic use of a reliable authorization to pull credit report template is not just a best practice, but a fundamental requirement. It simplifies a potentially complex legal process, ensures all parties are on the same page, and safeguards against misunderstandings, making the entire experience smoother and more secure for everyone.