Ah, business travel! It sounds glamorous, doesn’t it? Jet-setting to new cities, meeting important clients, and closing big deals. But for many, the excitement often gives way to a familiar dread when it comes to one particular task after the trip: compiling all those expenses. From tiny coffee receipts to hefty hotel bills, keeping track of every single penny spent can feel like an overwhelming puzzle, especially when you’re juggling different currencies and company policies.

This is where a little organizational magic comes into play. Imagine a world where every cost is neatly categorized, every receipt accounted for, and your reimbursement arrives without a hitch. Sounds like a dream, right? Well, it’s a dream that’s entirely achievable with the right tools. Instead of wrestling with crumpled papers and endless spreadsheets, you can streamline the entire process, making it less of a chore and more of a straightforward administrative task.

The secret to this newfound efficiency often lies in one simple yet powerful tool: a well-designed business travel expense report template. It’s more than just a form; it’s your personal assistant in managing finances on the go, ensuring accuracy, compliance, and ultimately, a much smoother reimbursement experience. Let’s dive into how such a template can transform your post-trip routine from a headache into a breeze.

Why a Business Travel Expense Report Template is Your Best Travel Companion

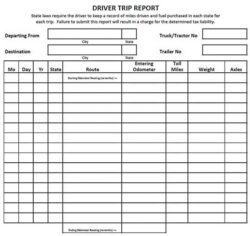

Think about all the elements that go into a business trip. There are flights, accommodation, ground transportation, meals, client entertainment, and sometimes even unexpected out-of-pocket expenses. Without a structured way to record these, it’s incredibly easy for details to get lost or forgotten, leading to stress, delays, and potentially even lost money. A dedicated business travel expense report template acts as your central hub for all financial records, ensuring nothing slips through the cracks.

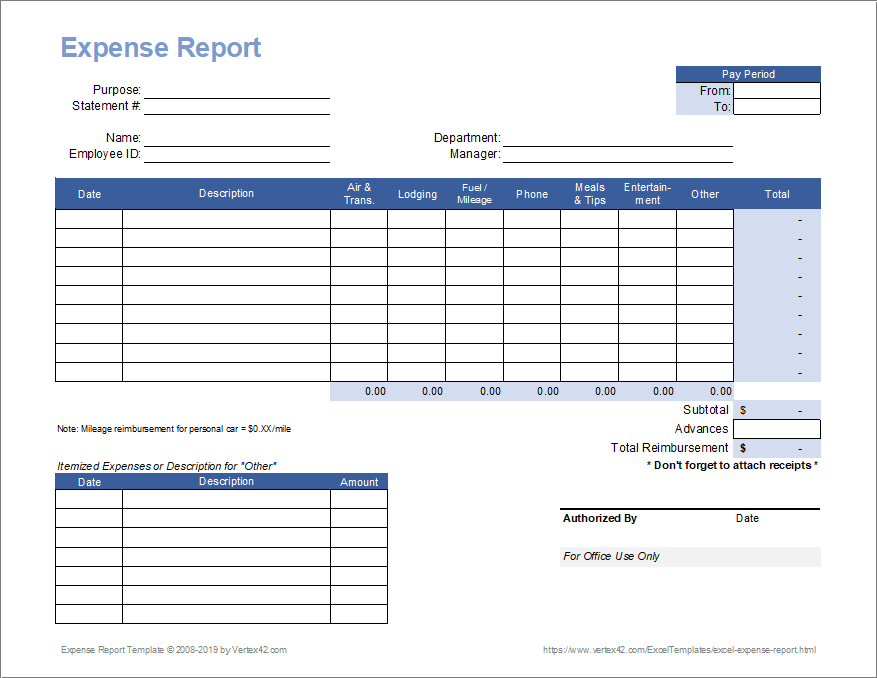

Beyond just basic organization, these templates play a crucial role in ensuring compliance. Every company has its own set of rules and limits for what can be expensed, and tax authorities like the IRS have strict guidelines on what constitutes a legitimate business expense. A good template prompts you to capture all the necessary information, such as the date, vendor, amount, purpose of the expense, and even the method of payment, helping you adhere to both internal policies and external regulations effortlessly. This proactive approach saves both you and your accounting department valuable time, preventing frustrating back-and-forth communication later on.

The benefits extend to efficiency for both the employee and the finance team. For the traveler, it means less time spent after the trip trying to reconstruct their spending. For the accounting department, it means clearer, more standardized submissions that are easier to review, verify, and process. This drastically speeds up the reimbursement cycle, putting money back into your pocket faster and reducing the administrative burden on everyone involved. It’s a win-win situation that fosters a more productive and harmonious working environment.

Furthermore, a consistent approach to expense reporting, facilitated by a template, provides invaluable data for future planning and budgeting. By analyzing past travel expenses, companies can identify trends, negotiate better deals with vendors, and refine their travel policies to be more cost-effective. This kind of insight is difficult to achieve when expense data is scattered across various unstandardized formats. It transforms individual expense reports into a powerful tool for strategic financial management.

Ultimately, using a reliable template is about peace of mind. You’ll have the confidence that all your legitimate expenses are documented properly, reducing the risk of disallowed claims or audit issues. It’s about ensuring you get every dollar you’re owed, without having to jump through hoops or spend hours deciphering old receipts. It takes the guesswork out of expense reporting, allowing you to focus on the more important aspects of your job rather than administrative drudgery.

Essential Components of a Robust Template

- Traveler Information: Name, department, employee ID.

- Trip Details: Destination, dates of travel, purpose of trip.

- Expense Categories: Clearly defined sections for accommodation, meals, transportation, client entertainment, etc.

- Date and Description: Fields for when and what the expense was for.

- Vendor and Amount: Who you paid and how much.

- Payment Method: Cash, credit card, personal, company.

- Receipt Attachment/Reference: Space to note if a physical receipt is attached or if a digital copy is available.

- Total Amount Due/Reimbursed: Summary calculations.

- Approval Signatures: Sections for employee and manager approval.

Tips for Maximizing Your Business Travel Expense Report Template

Adopting a business travel expense report template is the first excellent step, but truly maximizing its potential requires a few smart habits. Before you even set foot out the door, take a moment to understand your company’s specific expense policies. Knowing the per diems, limits on certain categories, and what requires pre-approval can save you a lot of grief later. Keep a digital or physical copy of these policies handy during your trip.

While you’re on the road, try to track expenses as they happen. Don’t wait until you’re back home, exhausted, with a pile of receipts threatening to overwhelm you. Many digital templates or apps allow for real-time entry, letting you snap photos of receipts and input details instantly. Even a simple note on your phone after each transaction is better than relying solely on memory. This proactive approach keeps your data fresh and accurate, reducing the chance of errors or forgotten items.

Once the trip is over, make it a priority to complete and submit your business travel expense report template promptly. This not only ensures timely reimbursement for you but also helps your company maintain accurate financial records. Double-check all entries against your receipts, ensuring totals are correct and all required fields are filled out. A thorough review before submission can prevent delays caused by incomplete information or discrepancies.