Life often throws unexpected curveballs our way, and sometimes those curveballs come in the form of a fender bender or a more serious collision. In the moments immediately following a car accident, it’s completely natural to feel shaken, confused, or even overwhelmed. Your mind might be racing, trying to process what just happened, assess any injuries, and deal with the other parties involved.

Amidst this chaos, one of the most critical steps you can take to protect yourself, your finances, and your legal standing is to meticulously document every detail of the incident. This isn’t just about insurance claims; it’s about creating an objective record that can serve as invaluable evidence later on, should disputes arise or legal action become necessary.

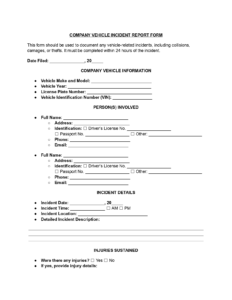

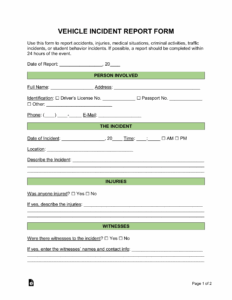

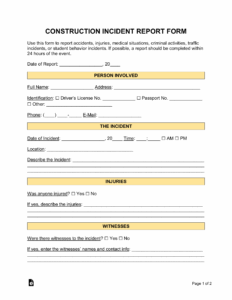

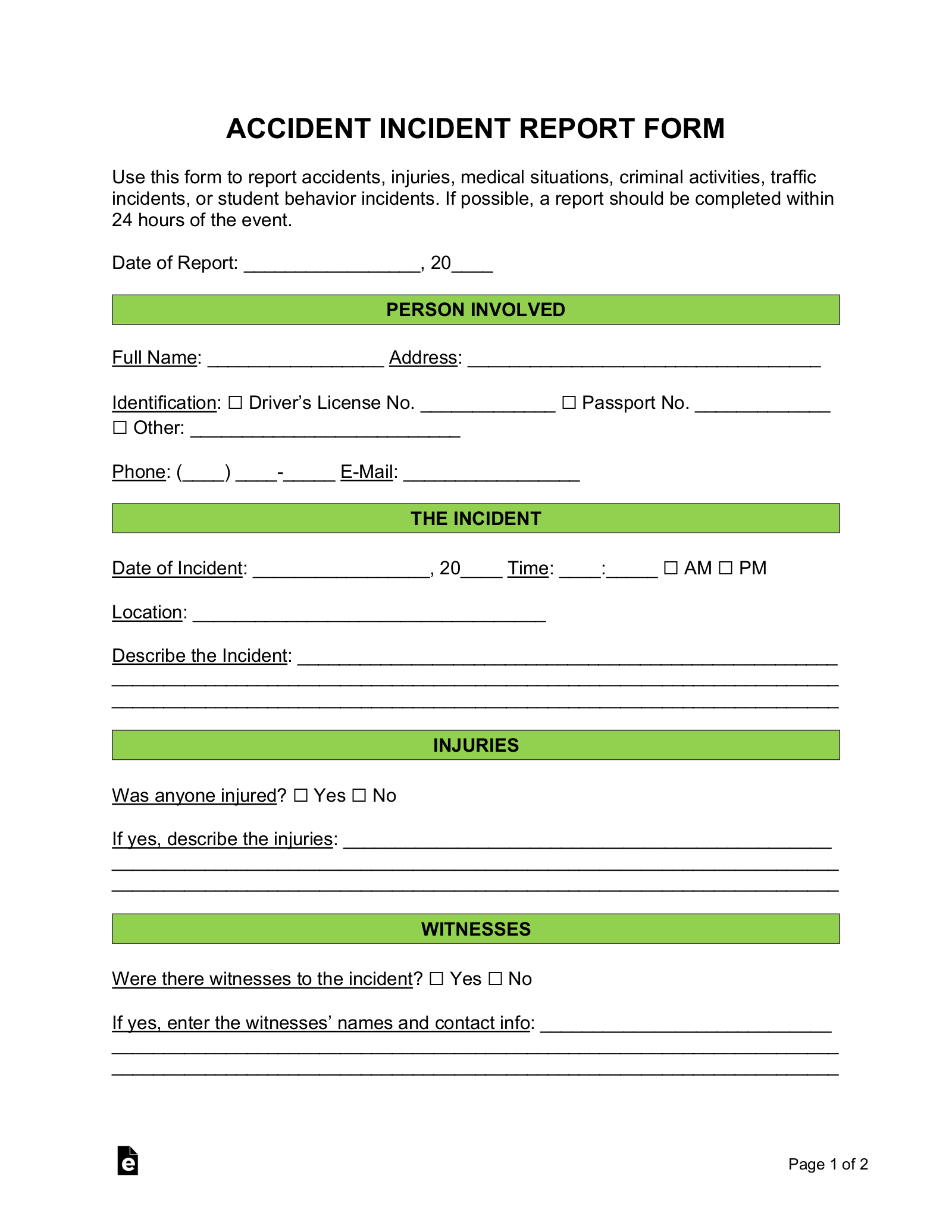

That’s where a well-structured car accident incident report template becomes your best friend. Having a clear guide helps you systematically gather all the necessary information, ensuring no crucial detail is overlooked when your mind might not be at its clearest. It transforms a potentially disorganized recollection into a comprehensive and actionable report.

Why a Detailed Incident Report Is Crucial

When the adrenaline fades after a car accident, memory can quickly become hazy, and the details that seemed so clear at the moment can become blurred. A detailed incident report acts as an anchor, preserving the factual elements of the event before they are forgotten or misinterpreted. It’s not just a formality; it’s a proactive measure to safeguard your interests and ensure a smoother resolution process.

From a legal perspective, your incident report can be a cornerstone of your case. It provides a timestamped account of the events, which can be crucial for police investigations, insurance adjusters, and even court proceedings. Without a thorough, written record, proving fault or substantiating claims for damages or injuries can become significantly more challenging. Memories can conflict, and witness statements can vary, making a concrete document indispensable.

Insurance companies, in particular, rely heavily on accurate and complete information to process claims. A comprehensive report accelerates the claims process, reduces back-and-forth communication, and helps ensure you receive fair compensation for damages or medical expenses. It clearly outlines the who, what, when, where, and how of the accident, leaving less room for ambiguity or disputes about the facts.

Furthermore, a detailed report helps protect you from potential future liabilities. If the other party tries to assign blame unfairly or exaggerates their damages, your precise account, supported by evidence like photos and witness statements, can refute false claims and present the truth. It’s your primary tool for accountability.

Key Information to Include in Your Report

- Date, exact time, and precise location of the incident (street names, cross streets, landmarks).

- Description of all vehicles involved, including make, model, year, color, license plate numbers, and Vehicle Identification Numbers (VINs).

- Driver information for all parties: full names, contact details, driver’s license numbers, and insurance policy information.

- Contact information for any passengers in your vehicle or other vehicles.

- Contact information for all witnesses present at the scene, if any, along with their statements.

- A detailed narrative describing how the accident occurred from your perspective, including traffic conditions, weather, and road conditions.

- Diagrams or sketches of the accident scene, showing vehicle positions, direction of travel, and points of impact.

- Photographs taken at the scene, capturing vehicle damage, road conditions, traffic signs, and any skid marks.

- Police report number, responding officer’s name, and police department contact information (if police were called).

- Details of any injuries sustained by anyone involved, including yourself, passengers, or other drivers/pedestrians.

- Description of all property damage, both to vehicles and any other objects (e.g., street signs, fences).

This comprehensive collection of data acts as a powerful factual foundation, ensuring that you have all the necessary components to build a robust claim or defense.

How to Use a Car Accident Incident Report Template Effectively

Having a car accident incident report template on hand, perhaps stored in your glove compartment or easily accessible on your phone, is an excellent first step towards being prepared. The true value, however, lies in knowing how to use it effectively in the immediate aftermath of an accident. A template provides a structured checklist, guiding you through the critical steps of information gathering, even when stress levels are high and it’s hard to think clearly.

When an accident occurs, after ensuring everyone’s safety and contacting emergency services if needed, refer to your template. It will prompt you to capture essential details that you might otherwise forget. Don’t wait until you get home; try to fill out as much as you can while still at the scene. This ensures the freshest recollection of events and allows you to gather visual evidence like photos before vehicles are moved or conditions change. Remember to be factual and objective, sticking to observable details rather than speculation.

Even after you’ve left the scene, your car accident incident report template continues to be a vital tool. You can use it to transcribe notes taken at the scene, add further details you might recall later, or organize information from witness follow-ups. Consolidating all this data into one comprehensive document makes it much easier to share with your insurance provider, legal counsel, or any other relevant parties, demonstrating your thoroughness and commitment to an accurate account.

Being prepared for an unexpected car accident can significantly reduce stress and improve outcomes. Taking the time to understand and utilize a thorough incident report template means you’re not just reacting to an event, but proactively safeguarding your rights and ensuring a clear path forward. It transforms a chaotic situation into a manageable process with verifiable facts.

Having a robust record of what transpired means you’re equipped to navigate the often-complex world of insurance claims and potential legal proceedings with confidence. It allows you to present a clear, consistent, and well-supported account, which is invaluable for a favorable resolution.