Managing business expenses can often feel like navigating a complex maze. With multiple team members using company credit cards or personal cards for work-related purchases, keeping track of every transaction becomes a significant challenge. This is where a clear, organized system is not just helpful but absolutely crucial for maintaining financial clarity and operational efficiency.

Without a structured approach, you might find yourself drowning in a sea of receipts, struggling to reconcile statements, and losing valuable time that could be spent on more strategic tasks. From client lunches to travel accommodations, every expenditure needs accurate documentation, not just for internal record-keeping but also for tax purposes and budget analysis. Imagine the peace of mind knowing every dollar spent is accounted for.

That peace of mind is precisely what a well-designed credit card expense report template can offer. It transforms a potentially chaotic process into a streamlined operation, ensuring that all necessary details are captured consistently. Whether you are a small business owner, a freelancer, or part of a larger corporate finance team, a reliable template provides the framework you need to simplify expense reporting and gain better control over your finances.

Why a Structured Credit Card Expense Report Template Is Indispensable

In today’s fast paced business environment, simply jotting down expenses on a napkin or relying solely on memory is a recipe for financial headaches. A dedicated credit card expense report template acts as your financial backbone, providing a systematic way to document every transaction. This level of organization is not just about neatness; it is about accuracy, accountability, and ultimately, saving your business money and time.

One of the primary benefits is the significant reduction in errors. Manual data entry is notoriously prone to mistakes, leading to discrepancies that can be time consuming and frustrating to resolve. By using a standardized template, employees are guided to input information in a consistent format, minimizing the chances of missing crucial details or miscategorizing expenses. This consistency ensures that financial data is reliable and ready for analysis at any given moment.

Furthermore, such a template greatly simplifies the reimbursement process. For employees who use their personal credit cards for business expenses, a clear report speeds up the approval and payment cycle. They can easily submit their documented expenses, and finance departments can quickly verify and process reimbursements, boosting employee morale and reducing administrative burden for everyone involved. It builds trust and clarity between employees and the company’s financial operations.

Beyond daily operations, a robust expense reporting system, built around a solid template, is vital for compliance and auditing. Regulatory bodies and tax authorities often require detailed records of business expenditures. Having a well-organized report makes it much easier to demonstrate compliance during an audit, potentially saving your business from penalties or complications. It provides a clear audit trail for every single purchase made with a company or personal credit card.

Finally, the data collected through these templates provides invaluable insights for budgeting and forecasting. By categorizing expenses consistently, you can identify spending patterns, spot areas where costs can be reduced, and make more informed financial decisions for future planning. This strategic advantage helps your business grow more efficiently and allocate resources more effectively, turning raw data into actionable intelligence.

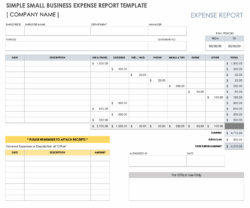

Key Elements to Include in Your Template

-

Date of Transaction: The exact date when the purchase was made.

-

Vendor Name: The name of the merchant or service provider.

-

Amount Spent: The total cost of the transaction.

-

Expense Category: A clear classification such as travel, meals, supplies, or client entertainment.

-

Purpose of Expense: A brief description explaining why the expense was incurred.

-

Payment Method: Specify if it was a company credit card, personal credit card, or other.

-

Receipt Attachment: A designated space or instruction for attaching or uploading digital copies of receipts.

Choosing and Customizing Your Credit Card Expense Report Template

With a plethora of options available, selecting the right credit card expense report template for your organization might seem overwhelming at first. The key is to find a template that aligns with your specific business needs, industry requirements, and the complexity of your expense structure. While generic templates are a good starting point, customization is often necessary to ensure it fully serves your unique operational flow and reporting requirements.

Consider whether you need a simple spreadsheet for a few employees or a more sophisticated system integrated with accounting software. Factors like the volume of transactions, the number of employees submitting reports, and the level of detail required for internal analysis or external audits will influence your choice. Look for templates that are user friendly, easy to understand, and minimize the time employees spend on administrative tasks. The simpler it is to use, the more likely it will be adopted consistently across your team.

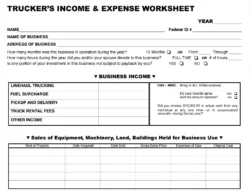

Customizing your chosen template involves tailoring fields and categories to reflect your company’s specific operations. For instance, a construction company might need specific categories for building materials or equipment rentals, while a marketing agency might focus more on digital advertising costs or client events. Adding custom fields for project codes or client names can further enhance the template’s utility, allowing for more granular tracking and better allocation of costs. Remember, the goal is to make the expense reporting process as efficient and insightful as possible.

When customizing, think about the future. Will your current template scale with your business growth? Can it accommodate new types of expenses or reporting standards as they emerge? Investing a little extra time upfront to develop a robust and adaptable credit card expense report template will pay dividends in the long run, ensuring that your financial tracking remains agile and effective as your business evolves.

Implementing a standardized system for managing credit card expenses is a fundamental step toward achieving financial mastery in any business. It transforms a often tedious and error prone task into a streamlined, accurate, and insightful process. By embracing a well structured approach, you empower your team with clarity, enhance accountability, and gain a deeper understanding of where your money is truly going.

Ultimately, this dedicated effort not only simplifies daily operations but also lays a strong foundation for strategic financial planning and sustained business growth. With organized records at your fingertips, you are better equipped to make informed decisions, optimize spending, and focus on what truly matters for your company’s success.