Navigating the complex world of credit card processing can feel like a daunting task for any business owner. You’re looking for the best rates, reliable service, and a system that integrates seamlessly with your operations. This is precisely where a well-structured credit card processing proposal template becomes an invaluable tool, helping you cut through the noise and objectively compare offers from various providers. It’s not just about finding the cheapest option, but about securing a partnership that truly supports your business growth and streamlines your payment acceptance.

Imagine having a clear, standardized framework to evaluate every offer that comes your way. Without such a template, you might find yourself juggling disparate documents, struggling to remember which provider offered what, and inadvertently overlooking crucial details or hidden fees. A template ensures that you ask the right questions, gather all necessary information consistently, and ultimately make an apples-to-apples comparison.

Ultimately, using a comprehensive template empowers you to save significant time and energy during your search. It transforms a potentially confusing process into a focused, organized endeavor, allowing you to confidently select a payment processing solution that aligns perfectly with your financial goals and operational requirements. It brings clarity to an often opaque industry, ensuring you understand exactly what you’re signing up for.

Crafting a Winning Proposal: What Your Template Must Include

When you’re evaluating credit card processing proposals, a robust template isn’t just a checklist; it’s your strategic advantage. It should be designed to capture all the critical details that impact your bottom line and operational efficiency, ensuring no stone is left unturned. Think of it as your personal guide to uncovering the true cost and value behind each offer, moving beyond introductory rates to understand the full scope of a provider’s service.

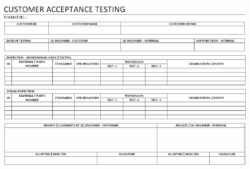

The very first section of any effective template should focus on the executive summary and a clear understanding of your business needs. This ensures the processor has taken the time to tailor their offering to you, not just provide a generic quote. It should outline your industry, typical transaction volume, average ticket size, and any specific requirements like e-commerce integration or mobile processing. This initial context sets the stage for a truly relevant proposal.

Transparent Pricing and Fee Structures

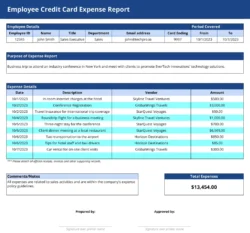

Perhaps the most crucial component is a detailed breakdown of pricing. This is where many businesses get tripped up, as credit card processing fees can be presented in various confusing ways. Your template needs to demand absolute transparency regarding the pricing model, whether it’s interchange-plus, tiered, or flat-rate. Each model has its pros and cons, and understanding which one you’re being offered is fundamental to comparing true costs.

Beyond the core pricing model, your template must itemize every single fee. This includes transaction fees per swipe, key-in, or online sale, along with monthly statement fees, gateway fees, PCI compliance fees, batch fees, and even potential annual fees. Don’t forget to inquire about chargeback fees, which can vary significantly and represent a substantial unexpected cost if not understood upfront. A good template will have dedicated spaces for each of these line items, preventing processors from bundling them or burying them in fine print.

Essential Features and Security Measures

Moving beyond costs, a comprehensive template should delve into the features and services offered. Does the proposal include a robust payment gateway, a virtual terminal for phone orders, or point-of-sale (POS) system integration? If you operate an e-commerce business, what are the integration options for your specific platform? Mobile processing capabilities for businesses on the go should also be a key consideration, along with any included hardware like card readers or terminals.

Security is non-negotiable in payment processing. Your template must ensure the proposal clearly outlines the provider’s adherence to PCI DSS compliance, details their fraud prevention tools, and explains security features such as tokenization and end-to-end encryption. These measures protect both your business and your customers’ sensitive data, mitigating the risk of costly breaches.

Finally, the template should cover customer support availability, service level agreements (SLAs), and dispute resolution processes. Understanding how and when you can get help, along with the terms of your contract, including length, early termination fees, and renewal clauses, is vital for long-term satisfaction.

Leveraging Your Template for Better Negotiations

Having a meticulously crafted template transforms the negotiation process from a passive acceptance of offers into an active, informed dialogue. Instead of simply receiving disparate proposals, you’ll be in a position to present your standardized template to each potential provider, requesting they fill it out directly. This immediately places you in control, ensuring you get the information you need in a format that facilitates direct comparison.

This systematic approach makes it incredibly easy to spot discrepancies, identify hidden charges, and pinpoint areas where one provider truly excels over another. You won’t have to decipher different jargon or try to extrapolate comparable data from varying document layouts. The template acts as a universal translator, allowing you to lay out multiple completed proposals side-by-side and immediately see the strengths and weaknesses of each option.

By presenting a consistent framework, you also signal to processors that you are a serious and discerning client. This often encourages them to offer their most competitive rates and terms upfront, knowing they are being evaluated against a clear standard. You can use the information from one completed credit card processing proposal template to ask pointed questions of another provider, pushing for better terms or clarification on specific fees. This empowers you to negotiate not just on price, but on overall value, service level, and contractual flexibility.

* Ensure all major cost components are clearly itemized.

* Compare contract durations and termination clauses side-by-side.

* Verify the inclusion of necessary integrations and security features.

* Evaluate customer support options and response times.

Ultimately, your goal isn’t just to find the cheapest processing, but the solution that offers the best overall value, reliability, and support for your specific business model.

Armed with a comprehensive, well-researched template, you move from merely hoping for a good deal to actively crafting one. This proactive stance ensures that your decision is based on solid data and a thorough understanding of all the implications, rather than being swayed by persuasive sales pitches or confusing pricing structures. It’s about building a robust foundation for your payment processing that supports your business for years to come.

Taking the time to utilize such a powerful tool means you’re investing in the financial health and operational efficiency of your business. It allows you to forge a partnership with a payment processor that truly understands and meets your needs, contributing to seamless transactions and customer satisfaction.