Embarking on any significant business transaction, whether it is an acquisition, a merger, or even a substantial investment, brings with it a whirlwind of complexities and potential risks. Peeling back the layers of a company to understand its true legal standing is not just a good practice; it is absolutely essential for making informed decisions. This investigative process, known as legal due diligence, is your primary shield against unforeseen liabilities and ensures you know exactly what you are getting into.

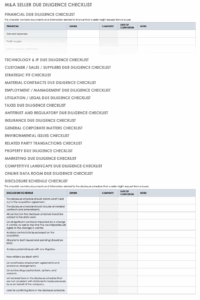

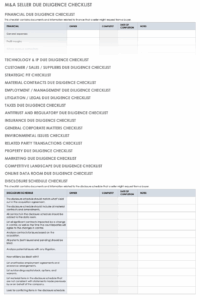

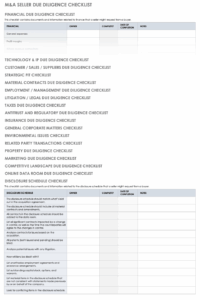

The sheer volume of documents, contracts, and legal obligations involved can be overwhelming without a structured approach. Imagine sifting through hundreds of files, trying to remember what you have checked and what is still pending. This is where a robust and comprehensive framework becomes invaluable. It provides a methodical pathway, ensuring no critical stone is left unturned and that all relevant legal aspects are meticulously reviewed.

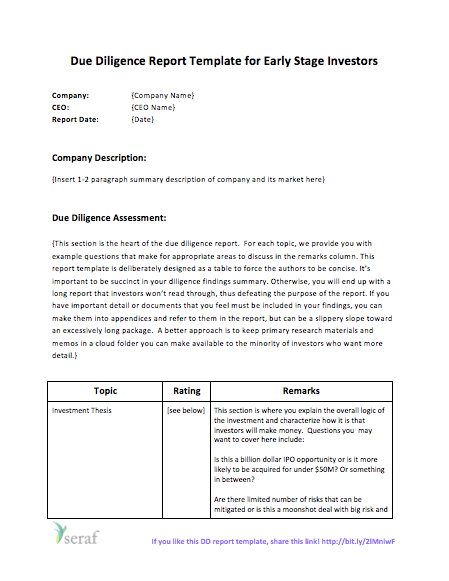

Having a well-designed legal due diligence report template at your disposal can dramatically streamline this often intricate and time-consuming process. It acts as your checklist, your organizer, and ultimately, your foundational document for conveying findings to stakeholders. It ensures consistency, saves precious time, and perhaps most importantly, minimizes the risk of overlooking crucial details that could have significant financial or operational implications down the line.

Key Sections of Your Legal Due Diligence Report Template

A truly effective legal due diligence report template needs to be exhaustive, covering every angle of the target company’s legal landscape. Think of it as painting a complete picture, where each brushstroke represents a different area of legal inquiry. Starting with the basics, you will want to establish the target’s corporate identity and history, moving through its operational agreements, potential legal battles, and how it manages its valuable intellectual property. This holistic view is crucial for understanding the entity’s health and potential risks.

Corporate Structure and Governance

The foundation of any legal due diligence begins with understanding how the company is set up and run. This section delves deep into the company’s legal existence, ensuring its formation was proper and its internal governance structures are sound. You will examine the official documents that define its identity and operational rules.

Some key items to review here typically include:

Material Contracts and Agreements

Businesses operate through a web of contracts, and understanding these agreements is paramount. This section uncovers the key operational, financial, and strategic agreements that bind the target company to other parties. These contracts often reveal the company’s core relationships, obligations, and revenue streams, as well as any potential liabilities.

A thorough review would encompass:

Beyond these, your legal due diligence report template should also dedicate significant sections to litigation and regulatory compliance, intellectual property, environmental matters, and employment law. Each of these areas can hold substantial risks or opportunities, and a meticulous review ensures that no aspect is underestimated. For instance, any ongoing litigation could represent a major financial drain, while robust intellectual property assets could be a significant value driver. The goal is to build a detailed and accurate profile of the target’s legal commitments and exposures.

Making Your Legal Due Diligence Report Template Work for You

While a comprehensive legal due diligence report template provides an excellent framework, its true power lies in its adaptability and how effectively it is utilized. No two transactions are exactly alike, and the specific nuances of each deal will dictate how you tailor and apply the template. It is not just about ticking boxes; it is about understanding the context of each piece of information and how it contributes to the overall risk assessment. Customizing the template to reflect the industry, the size of the target company, and the nature of the transaction will yield the most relevant and actionable insights.

Effective utilization also hinges on the quality of the team conducting the due diligence and their ability to communicate findings clearly. The template should guide their investigative process but also allow for the flexibility to pursue unexpected discoveries. It becomes a living document, evolving as more information comes to light, ultimately helping the team to identify red flags, assess their severity, and recommend mitigation strategies. Think of it as a dynamic tool that supports both the initial information gathering and the subsequent analysis phase.

Ultimately, the process of legal due diligence is iterative, often requiring follow-up questions and additional document requests. A well-structured template supports this back-and-forth, ensuring that all communications are documented and all requested information is tracked. It transforms a potentially chaotic information-gathering process into an organized, efficient, and thorough investigation, empowering decision-makers with the confidence needed to proceed, renegotiate, or walk away from a deal.

Navigating the complexities of business transactions demands precision and foresight. A meticulously crafted due diligence report is more than just a document; it is a critical instrument for risk mitigation and strategic planning. It distills vast amounts of information into a digestible format, highlighting both potential pitfalls and inherent strengths.

By adopting a structured approach, companies can transform what could be an overwhelming task into a manageable and insightful process. The clarity and detail provided in a well-executed report empower stakeholders to make informed decisions, ensuring that every step taken is based on a solid understanding of the legal landscape and its implications.