Ever wondered how to truly impress a potential client when presenting their insurance options? It often comes down to more than just competitive pricing; it’s about the clarity, professionalism, and personalization of your presentation. This is where a robust personal lines insurance proposal template becomes an indispensable tool for any insurance professional looking to stand out in a crowded market. It transforms a simple quote into a comprehensive, client-focused document that builds trust and clearly communicates value.

The goal isn’t just to provide numbers, but to paint a clear picture of how you can protect what matters most to your clients. A well-structured proposal helps them understand complex coverages, see the benefits of your recommendations, and feel confident in their decision to choose you as their trusted advisor. It acts as a detailed roadmap, guiding them through their options with ease and transparency.

Creating such a detailed and personalized document from scratch for every single client can be incredibly time-consuming and prone to inconsistencies. That’s why having a powerful template at your fingertips is a game-changer. It provides a solid foundation, allowing you to efficiently tailor each proposal to the individual needs of your clients while maintaining a polished, professional brand image.

Crafting an Impactful Personal Lines Insurance Proposal

When you present an insurance proposal, you’re not just delivering a quote; you’re delivering a promise of security and peace of mind. A truly impactful personal lines insurance proposal goes beyond a list of coverages and premiums. It tells a story, tailored specifically to the client, demonstrating that you understand their unique needs and have thoughtfully designed solutions to meet them. Think of it as your opportunity to shine, to differentiate yourself from competitors who might just hand over a generic printout.

The foundation of any strong proposal lies in its ability to clearly communicate value. This means breaking down complex insurance jargon into understandable language, highlighting the specific benefits of each policy recommendation, and showing how these recommendations address the client’s potential risks. It’s about educating them without overwhelming them, making them feel empowered in their decision-making process.

Understanding Your Client’s Unique World

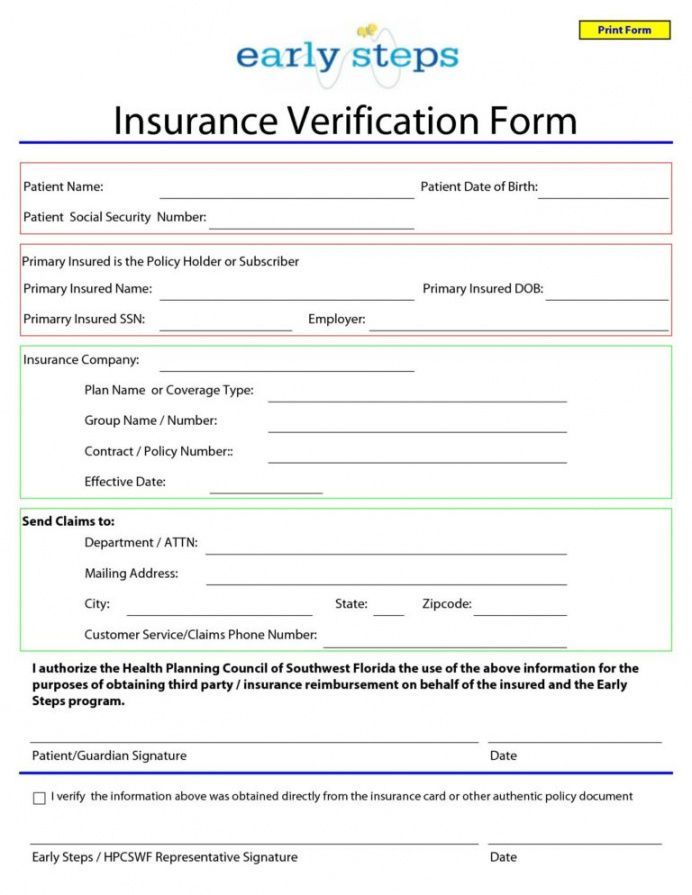

Before you even begin to talk about policies, the best proposals start with a deep dive into the client’s world. This section, often a needs assessment summary, should articulate your understanding of their assets, lifestyle, family situation, and any specific concerns they may have. It shows that you’ve listened intently and are not just selling a product, but providing a tailored solution. This could include details about their home, vehicles, valuable possessions, travel habits, or even their future aspirations like planning for a child’s education or retirement.

Once you’ve established this foundational understanding, the proposal moves into the core: the recommended coverage options. This part should clearly list the types of personal lines insurance suggested, such as homeowners, auto, umbrella, or valuable items coverage. For each recommendation, provide a concise explanation of what the coverage entails and, crucially, *why* it is important for the client. Connect it back to their identified needs and potential risks.

Transparency is paramount when it comes to premiums. Your proposal should feature a clear, itemized breakdown of costs for each policy, including any applicable discounts. Offering different deductible options or payment plans can also be a valuable addition, empowering clients to choose what best fits their budget. It’s not just about the final number, but about demonstrating how that number is derived and the flexibility available.

Finally, an impactful proposal concludes with a strong call to action and a summary of the unique value you bring. This might involve reiterating your commitment to exceptional service, highlighting your expertise, or simply providing clear next steps for the client to proceed. It’s about building a relationship, not just closing a sale, ensuring they feel supported throughout the entire process.

Leveraging a Personal Lines Insurance Proposal Template for Success

Imagine the time you could save if you didn’t have to format every document, retype common sections, or hunt for the right disclaimers for each new client. That’s the power of a well-designed personal lines insurance proposal template. It acts as a standardized framework, ensuring that every proposal you send out is professional, comprehensive, and consistent with your brand messaging. This efficiency allows you to focus more on client interaction and less on administrative tasks, ultimately boosting your productivity and client satisfaction.

While a template provides a strong backbone, its true strength lies in its adaptability. It’s not a rigid script but a highly customizable starting point. You should be able to easily plug in specific client details, adjust coverage recommendations, and tailor the language to resonate with each individual’s situation. This balance between standardization and personalization is key to delivering proposals that feel unique and relevant to every prospective policyholder.

By leveraging such a template, you not only save time but also enhance the overall client experience. The consistent, polished presentation reinforces your professionalism and attention to detail, instilling confidence in your clients. Moreover, it reduces the chances of oversight or missing crucial information, ensuring that every proposal is thorough and accurate.

- Standardized format for consistent branding

- Professional appearance that builds client trust

- Significant time-saving on document creation

- Reduced risk of errors or omitted information

- Easy to update with new products or regulations

- Facilitates quick customization for individual clients

Ultimately, a professionally crafted personal lines insurance proposal is more than just a document; it’s a critical component of your sales strategy and client relationship building. It embodies your expertise, commitment to client needs, and dedication to transparent communication, setting the stage for a long-lasting partnership. Investing time in perfecting your template means investing in your business’s future success.

By adopting and refining your personal lines insurance proposal template, you empower yourself to consistently deliver a superior client experience. You’ll be able to articulate value with clarity, inspire confidence through professionalism, and ultimately secure more business by demonstrating just how much you care about protecting what matters most to your clients.