Every business, no matter its size or industry, strives for success, and a crucial measure of that success lies in understanding its financial performance. Often referred to as an income statement, a profit and loss report provides a clear snapshot of your company’s revenues, costs, and expenses over a specific period. It’s the story of how much money your business made and how much it spent to get there, ultimately revealing your net profit or loss.

For many entrepreneurs and small business owners, creating such a detailed financial document can seem like a daunting task. Gathering all the numbers, organizing them correctly, and ensuring accuracy takes considerable time and effort, time that could often be better spent focusing on core business operations. This is where the practical utility of a pre-designed framework truly shines.

Imagine having a structured guide that simplifies this complex process, allowing you to plug in your figures and instantly see the bigger financial picture. That’s precisely what a well-crafted profit and loss report template offers: a clear, consistent, and easy-to-use tool to demystify your company’s financial health and guide better business decisions.

What Exactly is a Profit and Loss Report (and Why Do You Need One)?

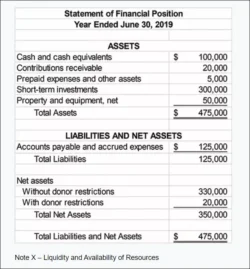

At its core, a profit and loss report, often abbreviated as a P&L, is one of the three main financial statements every business generates (the others being the balance sheet and cash flow statement). It summarizes the revenues, costs, and expenses incurred during a specific period – typically a quarter or a year. Unlike a balance sheet, which is a snapshot at a single point in time, the P&L tells a story of financial activity over a duration, showing how efficiently your business is converting sales into profit.

Understanding your P&L is absolutely vital for making informed business decisions. It helps you identify trends, assess the profitability of different product lines or services, and pinpoint areas where costs might be getting out of control. Without this essential document, you’re essentially flying blind, unable to accurately gauge your financial trajectory or the true health of your operations.

Think of it as your business’s report card. It doesn’t just tell you how much money is in your bank account today; it explains how that money got there (or didn’t get there) over time. This distinction is crucial because a healthy bank balance doesn’t always equate to a profitable business, and vice versa. The P&L provides the clarity needed to see the full financial picture.

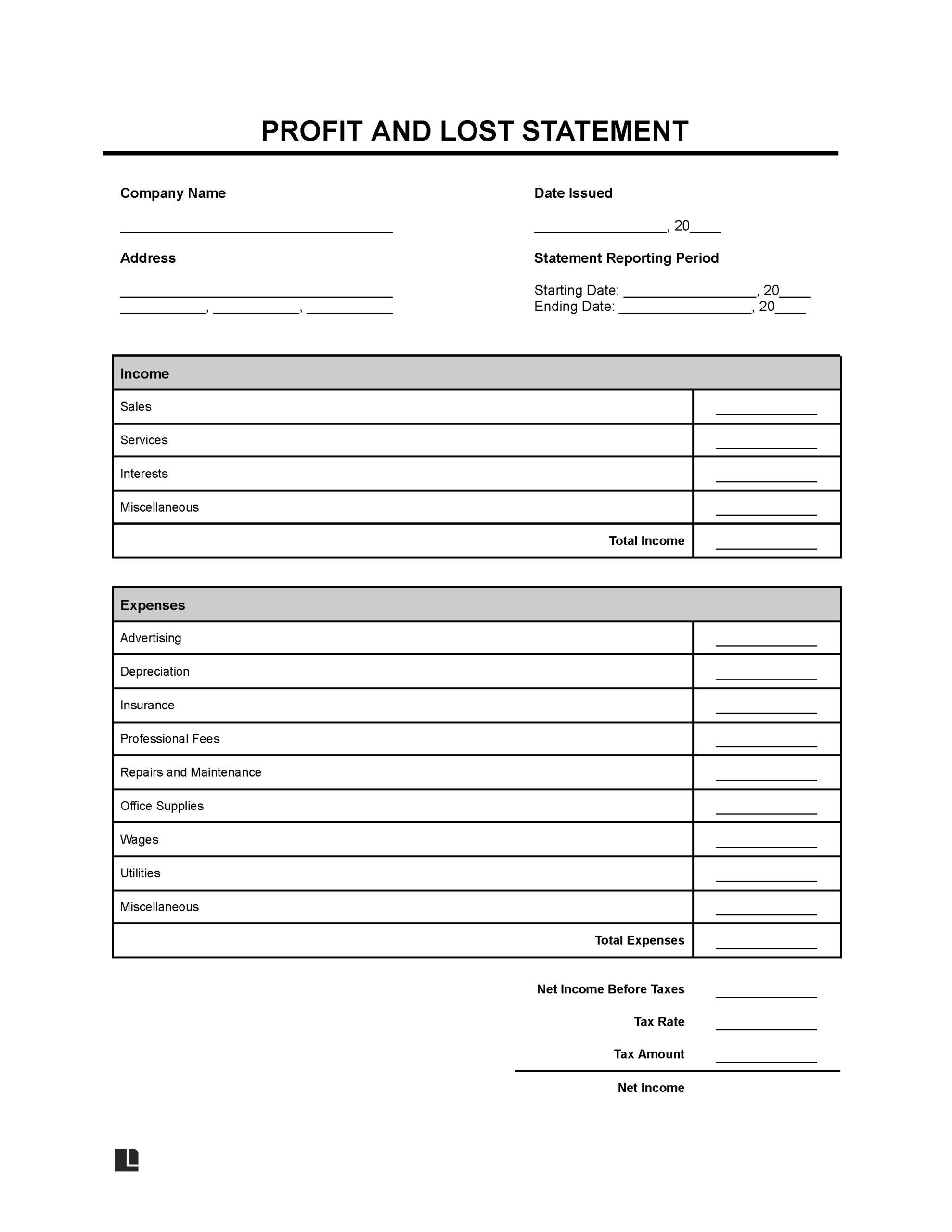

The report typically starts with your total revenue (sales), then subtracts the cost of goods sold (COGS) to arrive at your gross profit. From there, operating expenses like salaries, rent, marketing, and utilities are deducted, leading to your operating income. Finally, non-operating items like interest and taxes are factored in to reveal your net profit or loss for the period.

Key Benefits of Using a P&L Report:

- Track performance: Monitor your financial progress over time and against goals.

- Identify issues: Quickly spot declining revenues, rising costs, or inefficiencies.

- Make informed decisions: Guide pricing strategies, budgeting, and investment choices.

- Attract investors: Essential for demonstrating financial viability and growth potential to potential funders.

- Tax planning: Provides the necessary data for accurate tax calculations and filings.

Having a clear and regularly updated P&L is not just good practice; it’s a fundamental requirement for sustainable business growth and strategic planning.

How a Profit and Loss Report Template Saves You Time and Headaches

While the benefits of a P&L are undeniable, the process of constructing one from scratch can be intimidating. This is where a robust profit and loss report template becomes an invaluable asset for any business owner. Instead of staring at a blank spreadsheet, wondering where to begin, you get a pre-designed structure that guides you through every necessary step, ensuring you don’t miss any critical components.

A good template comes equipped with clearly labeled sections for all revenue streams, cost of goods sold, and various operating expenses. Many even include built-in formulas, automatically calculating gross profit, operating income, and net profit as you input your raw data. This not only dramatically reduces the time spent on manual calculations but also minimizes the risk of human error, giving you greater confidence in the accuracy of your financial overview.

Furthermore, these templates are often designed with flexibility in mind. Whether you’re a sole proprietor, a small startup, or a growing mid-sized company, you can customize the categories and details to perfectly match your unique business model. This adaptability means you get a professional-grade financial document without needing to be an accounting expert or invest in complex software.

- Clear, intuitive layout: Easy to navigate and understand, even for those new to financial reporting.

- Pre-programmed formulas: Automates calculations, saving time and preventing errors.

- Customizable categories: Adapt sections to fit your specific revenue and expense types.

- Consistent format: Ensures uniformity across reporting periods for easier comparison.

- Accessibility: Often available in common software formats, making them widely usable.

Embracing a ready-made structure for your financial analysis means you can shift your energy from formatting and calculations to actually interpreting the data. This allows for more strategic thinking, helping you to pinpoint opportunities for growth or areas that need immediate attention. It simplifies what can often be a complex and time-consuming task, making vital financial insights accessible to everyone.

Ultimately, having a clear and consistent method for tracking your company’s financial performance is non-negotiable for long-term success. By leveraging a well-designed framework, you empower yourself with the data needed to steer your business confidently, make astute decisions, and ensure its continued profitability and growth. It’s about turning raw numbers into actionable intelligence, without the inherent complexities of building the report from the ground up.