Running a small business is a whirlwind of tasks, from serving customers to managing inventory and marketing your services. Amidst all this activity, one crucial area that often gets overlooked, or at least feels like a chore, is tracking expenses. It’s easy for receipts to pile up, or for little costs to slip your mind, but ignoring them can lead to a muddled financial picture and missed opportunities for tax deductions.

Keeping a clear record of every dollar spent isn’t just about good bookkeeping; it’s about understanding your business’s financial health, making informed decisions, and ensuring you’re ready for tax season. Without proper tracking, you might overestimate your profits, undercharge for your services, or simply struggle to pinpoint where your money is actually going. This clarity is essential for sustainable growth.

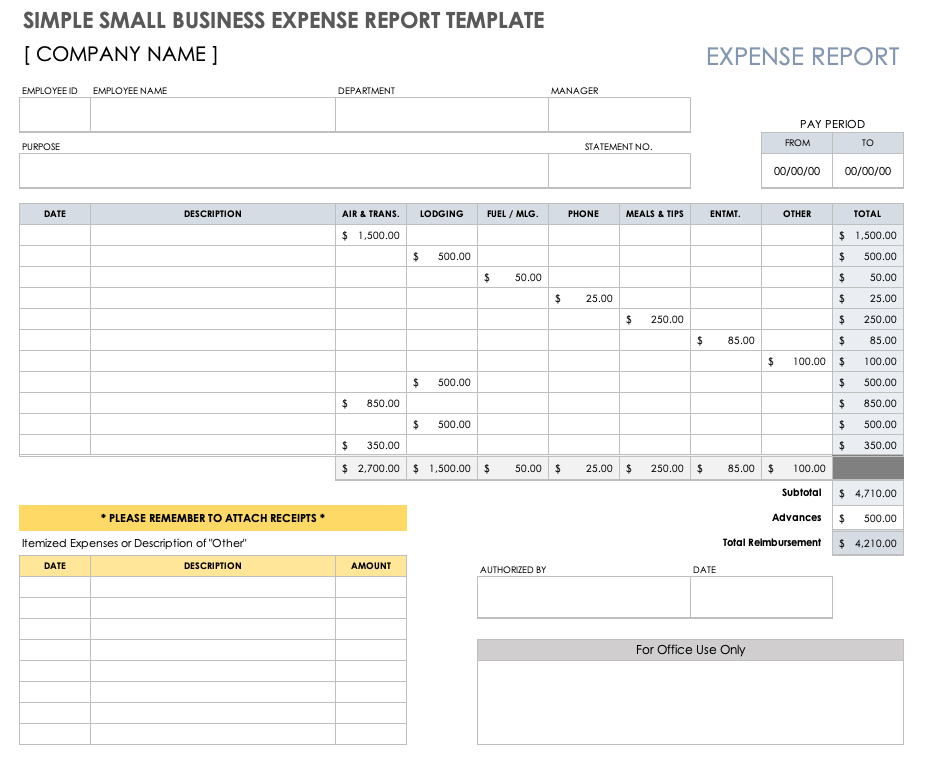

That’s where a reliable system comes in handy. Instead of scrambling through shoeboxes of receipts or trying to recall past purchases, having a structured approach makes all the difference. An effective small business expense report template can transform this daunting task into a manageable routine, giving you peace of mind and more time to focus on what you do best.

The Indispensable Role of an Expense Report Template for Small Businesses

For many small business owners, the idea of creating detailed expense reports might sound like something reserved for large corporations. However, nothing could be further from the truth. A dedicated small business expense report template is a powerful tool that levels the playing field, providing the same financial rigor and insight that bigger companies enjoy, but tailored for the unique needs and often tighter resources of a smaller operation. It’s not just about paperwork; it’s about financial empowerment.

Think about the time you spend each month trying to reconcile your bank statements or piece together what various charges were for. This valuable time could be redirected to core business activities if you had a clear system in place. An expense report template standardizes the information you collect, ensuring consistency and making the process of categorizing expenditures, whether for office supplies, travel, or client entertainment, much more straightforward.

Moreover, preparing for tax season can be a significant source of stress for small business owners. When all your expenses are neatly documented in a consistent format, you’re not just saving time; you’re also reducing the likelihood of errors and ensuring you capture every eligible deduction. This proactive approach can significantly impact your tax liability, potentially saving you a substantial amount of money that can then be reinvested into your business.

Beyond taxes, these templates are vital for internal financial analysis. They help you visualize spending patterns, identify areas where you might be overspending, and pinpoint opportunities to cut costs. This kind of detailed insight is crucial for effective budgeting and strategic planning, allowing you to allocate resources more efficiently and make data-driven decisions about future investments and growth initiatives.

Finally, if your small business has employees, an expense report template is indispensable for managing reimbursements. It provides a clear framework for employees to submit their expenses, along with supporting documentation, and for you to review and approve them transparently. This fosters trust, reduces disputes, and ensures that everyone understands the process for claiming work-related costs. It makes the entire reimbursement cycle smoother and more accountable for all parties involved.

Key Benefits of Using a Small Business Expense Report Template

- Simplifies tax preparation and maximizes deductions.

- Enhances budgeting and financial forecasting accuracy.

- Improves cash flow management by tracking outflows.

- Streamlines employee reimbursement processes.

- Provides clear, auditable records for compliance.

- Saves time by standardizing expense tracking.

Crafting and Implementing Your Ideal Expense Reporting System

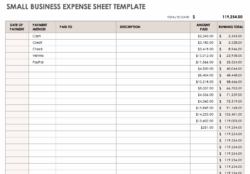

Once you recognize the immense value of an expense report template, the next step is to choose or create one that perfectly fits your small business. There isn’t a one-size-fits-all solution, as every business has unique needs, spending habits, and operational structures. You might start with a basic spreadsheet template available online, or perhaps opt for a more sophisticated solution integrated with accounting software. The key is to select a format that is intuitive for both you and anyone else in your team who will be using it.

When customizing your template, think about the categories of expenses that are most relevant to your business. Common categories include travel, meals and entertainment, office supplies, utilities, software subscriptions, and professional development. Ensuring these are clearly defined will make tracking much easier and more consistent. Also, consider what supporting documentation will be required – typically receipts, but sometimes invoices or bank statements – and how that documentation will be attached or linked to each entry in the report.

Implementing your new expense reporting system effectively involves more than just having a great template; it requires clear communication and consistent application. If employees are involved, make sure they are thoroughly trained on how to use the template, what information is required for each expense, and the deadlines for submission. Establishing clear policies on what expenses are reimbursable and what limits apply is also critical to prevent misunderstandings and ensure compliance with your business’s financial guidelines.

- **Consider Existing Tools:** Many accounting software solutions (e.g., QuickBooks, Xero) offer integrated expense tracking, which can be even more seamless.

- **Start Simple:** Don’t overcomplicate it initially. You can always add more detail as your business grows and your needs evolve.

- **Regular Reviews:** Periodically review your template and process. Are there categories you need to add or remove? Is the system still efficient?

- **Digital vs. Manual:** Decide if you want to go fully digital with scans and cloud storage, or if a physical filing system for receipts works better for your workflow.

Taking control of your small business expenses doesn’t have to be a daunting task. By embracing a structured approach with a well-designed template, you’re not just organizing receipts; you’re building a foundation for greater financial clarity and control. This simple yet powerful tool empowers you to make smarter decisions, optimize your spending, and ensure your business remains on a healthy financial trajectory.

Investing a little time now to set up an efficient expense reporting system will pay dividends in the long run. It frees you from the stress of last-minute financial scrambles and allows you to focus your energy on growth, innovation, and serving your customers better, knowing that your financial house is in perfect order.