Running a small business is a whirlwind of passion, innovation, and often, a bit of controlled chaos. You are the visionary, the marketer, the customer service expert, and perhaps even the delivery driver. Amidst all these hats, it is easy for the financial side of your operation to feel like a complex puzzle you just do not have time to solve. Yet, truly understanding your money is not just about paying bills or filing taxes; it is about steering your business towards sustainable growth and making informed decisions that pay off in the long run.

Many business owners feel intimidated by the thought of financial reporting. The terms sound complex, the numbers can be overwhelming, and the process seems time-consuming. You might wonder where to even begin, or if you are doing it correctly. This feeling is completely normal, but it should not deter you from gaining crucial insights into your company’s performance.

That is where a well-designed small business financial report template comes into play. It is not just a document; it is a powerful tool designed to demystify your finances, providing a clear snapshot of your business’s health without requiring you to be an accounting wizard. With the right template, you can transform daunting data into actionable intelligence, empowering you to make smarter choices for your future.

Why Financial Reports are Your Business’s Essential Compass

Think of your financial reports as the dashboard of your business, providing critical gauges and indicators that tell you exactly what is happening under the hood. They are not merely historical records; they are predictive tools that help you anticipate future challenges and opportunities. Without them, you are essentially driving blind, making decisions based on guesswork rather than solid data. These reports allow you to track performance over time, compare results against your goals, and identify areas where you are excelling or where improvements are needed.

They empower you to ask questions like: Is this new product line actually profitable? Can we afford to hire another employee? Are our expenses growing faster than our revenue? By regularly reviewing these documents, you gain a deep understanding of your operational efficiency, your cash flow patterns, and your overall financial stability. This proactive approach helps you spot potential problems before they escalate and allows you to capitalize on strengths.

Furthermore, accurate financial reports are indispensable when seeking external funding, whether it is a bank loan or an investment from a venture capitalist. Lenders and investors rely heavily on these documents to assess your business’s viability and its potential for return. A clear, well-maintained set of reports demonstrates professionalism and a thorough understanding of your business, significantly increasing your chances of securing the capital you need to expand.

Understanding Key Financial Statements

When we talk about financial reports, there are typically three core statements that form the backbone of your business’s financial narrative. Each one tells a different, yet interconnected, story about your money. Understanding these distinct reports is the first step towards effectively using any small business financial report template.

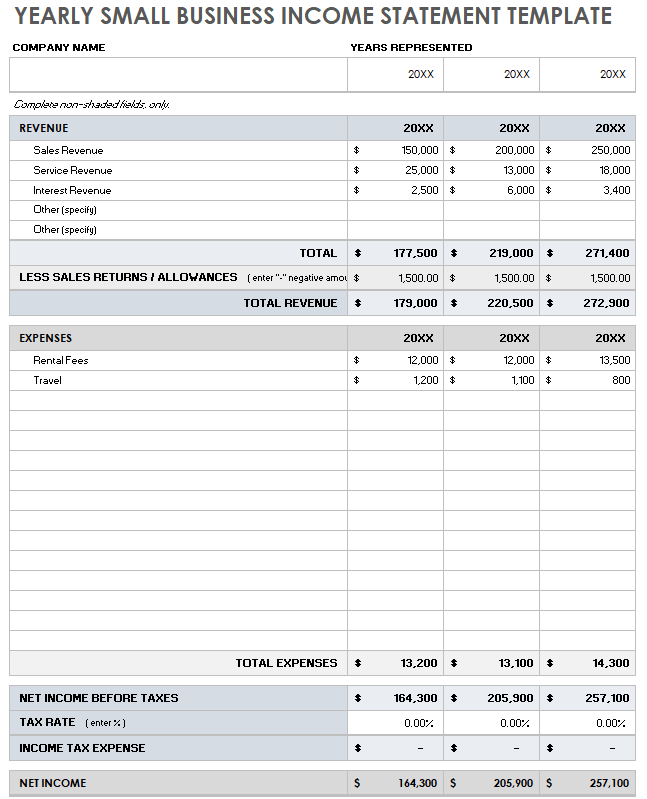

The Income Statement, often called the Profit and Loss (P&L) statement, shows your revenues and expenses over a specific period, revealing your net profit or loss. It is like a scorecard, telling you how profitable your business has been.

Next, the Balance Sheet offers a snapshot of your business’s financial health at a specific point in time. It details what your business owns (assets), what it owes (liabilities), and the owner’s equity. This statement adheres to the fundamental accounting equation: Assets equal Liabilities plus Owner’s Equity.

Finally, the Cash Flow Statement tracks the actual cash coming into and going out of your business. It categorizes cash flows into operating, investing, and financing activities, providing a clearer picture of your liquidity than just the Income Statement. You can be profitable on paper but still run out of cash, so this report is vital.

These foundational reports collectively provide a comprehensive view, allowing you to:

- Track your true profitability over months or years

- Assess your overall financial strength and solvency

- Monitor the flow of cash to ensure you can meet obligations

- Identify financial trends and seasonal variations

- Aid in future financial planning and budgeting

Crafting Your Ideal Small Business Financial Report Template

The beauty of a small business financial report template is its adaptability. While there are standard formats, the best template for you is one that you can easily understand, populate, and utilize for making decisions specific to your industry and business model. You might start with a general template and then customize it to include metrics that matter most to your unique operations. This customization ensures that the data you are tracking is always relevant and actionable.

Beginning the process might involve choosing a pre-made template from an accounting software, a spreadsheet program, or even an online resource. The key is to select one that is intuitive and allows for easy data entry. Remember, consistency is crucial. Regular input and review of your financial data will yield the most benefits. Even if you start simple, the habit of financial reporting will become incredibly valuable as your business grows and its financial landscape becomes more complex.

Think about the specific information you need to see at a glance. Do you need a detailed breakdown of expenses by category, or a simplified overview of your top revenue streams? Your template should be structured to highlight these insights. Consider including sections for historical comparisons, budget versus actual results, and even brief analytical notes where you can summarize key takeaways or plan next steps. The more tailored your small business financial report template is to your business, the more powerful it will become as a management tool.

- Clearly defined reporting periods (monthly, quarterly, annually)

- Categorized sections for all income sources

- Detailed breakdown of operating and non-operating expenses

- Separate segments for assets, liabilities, and owner’s equity

- An organized flow for cash inflows and outflows

- Space for notes, observations, and actionable insights

Embracing the power of consistent financial reporting will transform how you manage your small business. By regularly examining a well-structured small business financial report template, you move from reactive problem-solving to proactive strategic planning. This clarity empowers you to identify opportunities, mitigate risks, and confidently navigate the financial complexities of running your own venture.

Making financial analysis a regular part of your business rhythm, even for just a few hours a month, provides an invaluable roadmap for sustainable success. It is not just about crunching numbers; it is about building a clearer, more resilient future for your business, allowing you to focus on what you do best while knowing your finances are firmly under control.