Navigating the world of audits can sometimes feel like deciphering a complex puzzle, especially when an organization requires a report that goes beyond the standard financial statements. While general purpose financial audits provide a broad overview, there are numerous situations where a more focused, precise examination is needed. These specific scenarios demand a tailored approach, leading to what we call a special purpose audit.

A special purpose audit zeroes in on particular aspects of an entity’s financial information or operations, often driven by contractual obligations, regulatory requirements, or the specific needs of a user group. Think of it as a custom-made suit, perfectly fitted for a particular event, rather than an off-the-rack garment. The output of such an audit needs to be equally precise and clear, communicating findings directly relevant to its unique objective.

This is precisely where a well-structured special purpose audit report template becomes an invaluable asset. It provides a foundational framework, ensuring that all critical elements are included while allowing for the necessary flexibility to adapt to the diverse nature of these specialized engagements. Having a reliable template can streamline the reporting process, enhance clarity, and ensure consistency across various special purpose audit tasks.

Understanding the Nuances of Special Purpose Audits

Special purpose audits are a fascinating and essential part of the auditing landscape, distinguishing themselves by their focused scope and specific reporting objectives. Unlike a general audit that aims to provide an opinion on the fairness of financial statements as a whole, a special purpose audit tackles a very particular question or set of questions. This specificity means that the audit procedures, the evidence gathered, and consequently, the report itself, are all designed with a targeted outcome in mind. It’s about answering “Is X compliant with Y?” or “Does Z accurately represent A?” rather than “Are these financial statements fair?”.

What Makes an Audit “Special Purpose”?

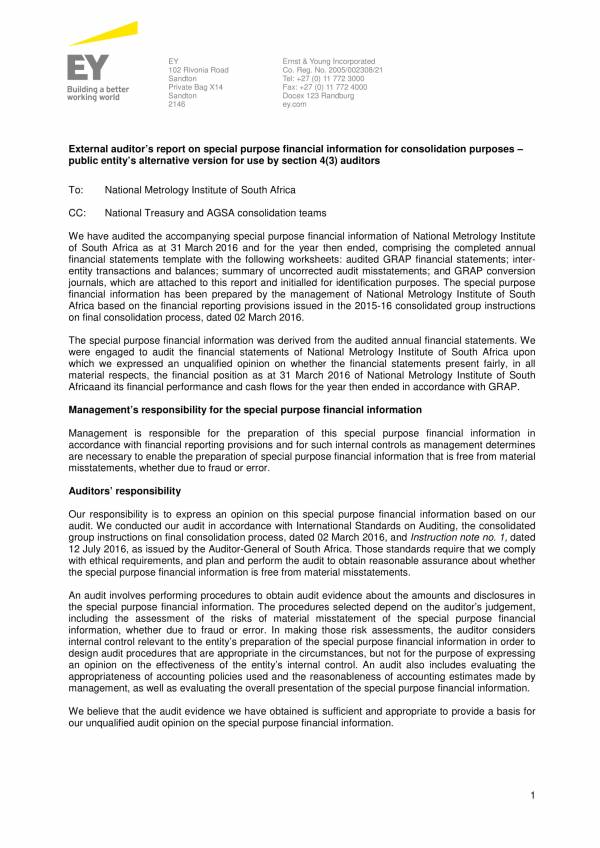

Special purpose audits are defined by several key characteristics that set them apart. Firstly, they often relate to specific elements, accounts, or items of a financial statement, rather than the complete set. For example, an audit might focus solely on a company’s sales revenue to verify royalty calculations, or on a specific grant expenditure to ensure compliance with donor stipulations. Secondly, the reporting framework used is typically a “special purpose framework” which could be a cash basis of accounting, a regulatory basis, or even the provisions of a contract. Thirdly, the report is usually intended for specific users who have an interest in that particular information, rather than a broad public audience.

Consider scenarios like auditing a company’s compliance with loan covenants, examining the financial information included in a prospectus, or reviewing internal controls for a specific operational area. Each of these requires a distinct approach and a report that speaks directly to the purpose of the engagement. The auditor’s opinion will also be customized, addressing the specific subject matter and reporting criteria, which underscores the need for a precise special purpose audit report template.

Key Components of a Robust Special Purpose Audit Report Template

Developing an effective special purpose audit report template involves incorporating several critical components that ensure completeness, clarity, and compliance. The report typically begins with a clear title and addresses the specific user or entity requesting the audit. This immediately sets the stage for the report’s purpose and audience.

Following this, a detailed description of the scope and objective of the audit is paramount. This section clarifies what was examined, what criteria were used for the examination, and what the report aims to achieve. Given the bespoke nature of these audits, this clarity helps prevent misunderstandings about the auditor’s findings and opinions.

The report must also explicitly state the reporting framework utilized. Whether it’s a cash-basis, regulatory-basis, or contractual basis of accounting, outlining this provides context for the financial information presented. This is a significant differentiator from general purpose audits, which typically adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Crucially, the template will then feature the auditor’s findings and opinion, which are meticulously tailored to the specific engagement. This section might include factual findings, compliance assessments, or an opinion on the fair presentation of the specific information audited under the stated framework. Finally, restrictions on the use and distribution of the report are often included, reminding recipients that the report is intended for specific purposes and users.

- Auditor’s Opinion tailored to the specific subject matter

- Management’s Responsibility for the subject matter

- Auditor’s Responsibility and scope of work performed

- Basis for Opinion, referencing the specific reporting framework

- Description of Specific Engagement, detailing objectives and criteria

Tailoring Your Special Purpose Audit Report for Maximum Impact

While a special purpose audit report template provides an invaluable starting point, its true power is unleashed through intelligent customization. No two special purpose audits are exactly alike, and therefore, no two reports should be identical. The template serves as a robust skeleton, but the “flesh” of the report—the specific details, findings, and language—must be meticulously added to reflect the unique circumstances of each engagement. This customization ensures that the report is not only accurate but also highly relevant and actionable for its intended users.

The art of tailoring lies in understanding the specific needs of the report’s audience and the precise questions the audit was designed to answer. For instance, a report for a regulatory body will emphasize compliance and adherence to specific rules, using technical language familiar within that sector. Conversely, a report for a board of directors about a specific project’s expenditures might focus more on efficiency, cost-effectiveness, and recommendations for improvement, presented in clear, business-oriented language. Customizing the narrative, the level of detail, and even the emphasis of the findings will significantly enhance the report’s impact and usability.

Furthermore, integrating specific examples, data points, and context directly related to the audit’s findings breathes life into the template. Instead of generic statements, the report should present concrete evidence and explanations that support the auditor’s conclusions. This attention to detail, coupled with a clear and concise writing style, transforms a mere document into a powerful communication tool. By conscientiously adapting each section of your special purpose audit report template, you ensure that the final output delivers maximum value and clarity to everyone involved.

Embracing a specialized reporting framework for a targeted audit allows organizations to gain precise insights, addressing particular concerns or fulfilling specific obligations with confidence. The meticulous preparation of such reports, guided by a flexible yet comprehensive template, ensures that the findings are not only accurate but also effectively communicated to the relevant stakeholders. This focused approach ultimately leads to more informed decision-making and enhanced accountability within any entity.