Embarking on a merger, acquisition, or significant investment can be an exhilarating journey filled with immense potential. However, beneath the surface of exciting opportunities often lie complex layers of financial and operational intricacies. Navigating these requires a meticulous approach, and that’s precisely where the critical process of due diligence steps in, acting as your indispensable guide to understanding the true health and prospects of a target company.

Among the various facets of this comprehensive review, tax due diligence holds a unique and profoundly important position. It’s not just about crunching numbers; it’s about uncovering potential liabilities, identifying hidden tax exposures, and even recognizing valuable tax assets or incentives that could significantly impact the deal’s economics. Overlooking this crucial step can lead to unforeseen financial burdens, compliance headaches, and ultimately, a substantial erosion of the transaction’s intended value.

Given the intricate and ever-evolving landscape of tax laws, ensuring a thorough and systematic review is paramount. This is where a robust tax due diligence report template becomes an invaluable asset. It provides a structured framework, ensuring that no stone is left unturned and that all relevant tax areas are rigorously examined, giving you a clear, consolidated picture of the target’s tax standing.

Understanding the Core Components of a Comprehensive Tax Due Diligence Report

A tax due diligence report is much more than a simple checklist; it is a strategic document that provides an in-depth analysis of a target company’s tax affairs. This review typically spans historical periods and assesses future tax implications, aiming to present a holistic view of tax risks and opportunities. The process involves scrutinizing various financial records, legal documents, and tax filings to construct an accurate profile of the target’s tax health.

The primary objectives of such a report are multifaceted. It seeks to identify any potential tax liabilities that might be lurking unrecognized on the balance sheet, whether they arise from incorrect tax treatments, unfiled returns, or pending tax audits. Simultaneously, it aims to pinpoint any unrecorded tax assets, such as net operating losses or tax credits, which could offer future tax savings and enhance the deal’s value. Ultimately, it’s about empowering stakeholders with the knowledge needed to make informed decisions and appropriately adjust the transaction price or terms.

The scope of a tax due diligence report is broad, encompassing a wide array of tax types. This includes, but is not limited to, corporate income tax, value-added tax (VAT) or sales tax, payroll taxes, customs duties, and any other specific local or international taxes relevant to the target’s operations. Each tax category requires a specialized review to ensure compliance with applicable regulations and to assess any associated risks.

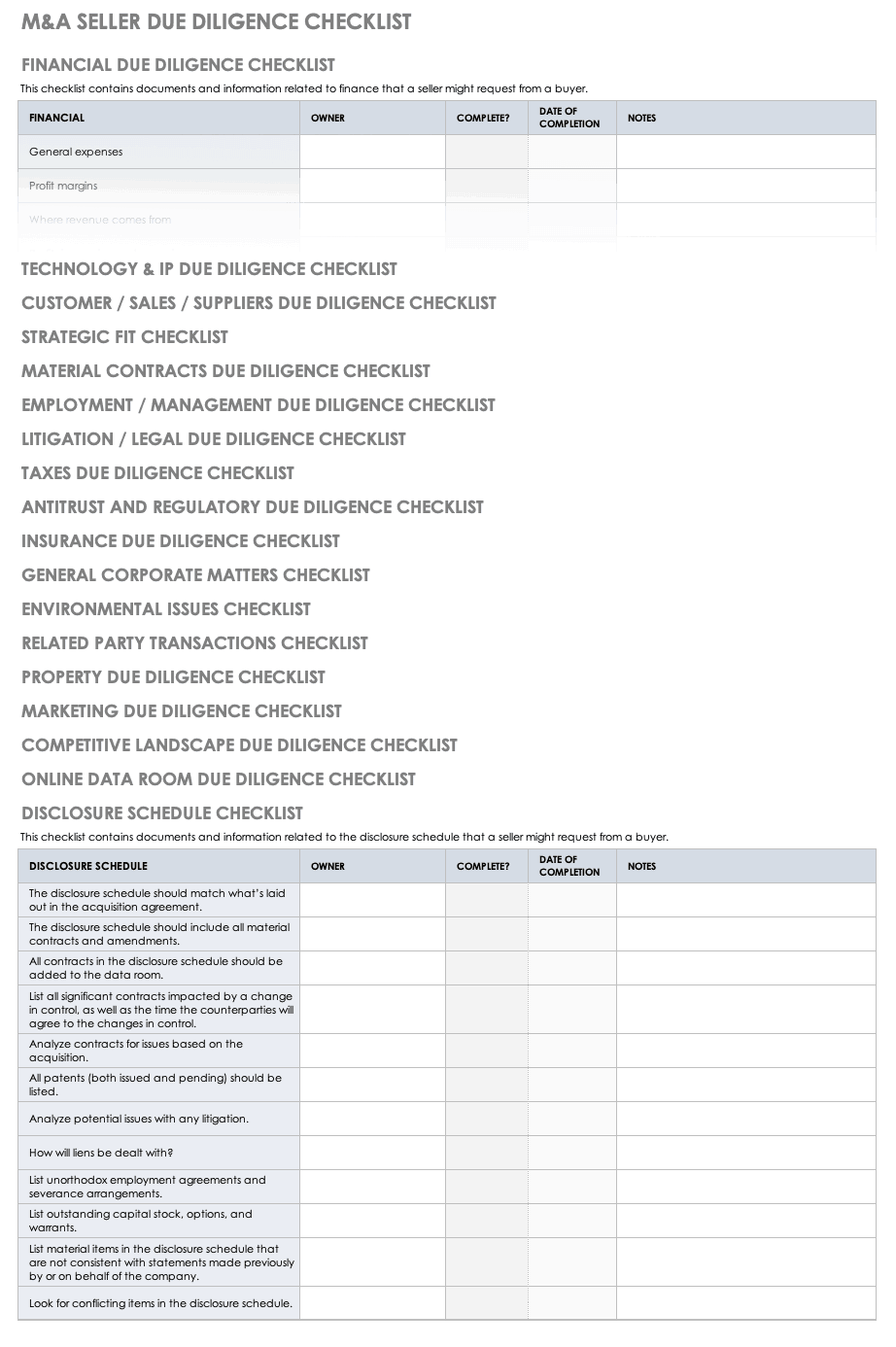

Typically, the due diligence process follows a structured methodology. It begins with a comprehensive data request list, followed by a meticulous review of the gathered documents. This is succeeded by a period of analysis, where tax professionals evaluate the data, identify discrepancies, and assess potential exposures. The findings are then consolidated into the final report, often including a summary of key issues and recommendations for risk mitigation or further action. A well-designed tax due diligence report template streamlines this entire workflow, ensuring consistency and thoroughness.

The benefits of a meticulously prepared report extend beyond merely identifying risks. It provides valuable negotiation leverage, allowing the buyer to factor in potential tax costs or benefits into the deal structure. Furthermore, it helps in the post-acquisition integration phase, ensuring a smoother transition and avoiding unexpected tax surprises down the line. A robust report acts as a foundational document for strategic planning, safeguarding the investment from unforeseen tax-related complications.Key Sections within the Template

- Executive Summary: A concise overview of the most significant tax findings and recommendations.

- Scope and Methodology: Details of the review period, taxes covered, and the approach taken.

- Corporate Income Tax Review: Examination of historical tax returns, carryforwards, and significant tax positions.

- Indirect Tax Review (VAT, Sales Tax, GST): Analysis of compliance, registrations, and potential liabilities related to indirect taxes.

- Payroll Tax and Employee Benefits Review: Assessment of payroll tax compliance, social security contributions, and employee benefit plans.

- International Tax Issues: Evaluation of transfer pricing, permanent establishment risks, and cross-border transactions for multinational entities.

- Tax Litigation and Disputes: A summary of any ongoing or potential tax audits, appeals, or litigations.

- Tax Registrations and Licenses: Verification of all necessary tax registrations and licenses.

- Tax Holidays and Incentives: Identification and assessment of any tax incentives, subsidies, or special regimes the target benefits from.

- Summary of Key Findings and Recommendations: A detailed list of identified risks, opportunities, and proposed actions.

- Appendices: Supporting documentation, such as reviewed tax returns, correspondence with tax authorities, and legal opinions.

Leveraging a Tax Due Diligence Report Template for Efficiency and Accuracy

The true power of a well-crafted tax due diligence report template lies in its ability to standardize a complex process, injecting both efficiency and consistency into what can often be a sprawling and time-consuming undertaking. By providing a predefined structure and sections, it ensures that all critical areas are systematically addressed, reducing the risk of oversight and creating a uniform approach across different transactions or teams. This standardization doesn’t just make the process smoother; it significantly enhances the reliability and comparability of the reports generated.

Using a template actively contributes to saving valuable time and minimizing potential errors. It acts as a comprehensive checklist, guiding professionals through the myriad of tax regulations and relevant documentation, preventing critical steps from being missed. While templates offer a strong foundation, they are typically flexible enough to be customized, allowing teams to adapt them to the specific nuances of each target company or industry. This adaptability ensures that the template remains a practical tool, rather than a rigid constraint, tailored to extract the most relevant tax insights.

Moreover, a robust tax due diligence report template serves as an excellent communication tool. It clearly presents complex tax findings in an organized and understandable format for all stakeholders involved, from legal advisors and financial analysts to the ultimate decision-makers. This clarity is especially vital during negotiations, as it provides a common ground for discussing identified tax risks, liabilities, and opportunities, fostering a transparent environment and facilitating equitable deal terms for all parties concerned with the tax due diligence report template.

In the high-stakes world of corporate transactions, thoroughness in every detail is not merely a preference; it is an absolute necessity. Proactive identification and precise evaluation of tax exposures and opportunities can be the difference between a deal that creates lasting value and one that leads to unexpected financial setbacks. It requires a keen eye for detail and an unwavering commitment to understanding the complete picture.

Ultimately, having a comprehensive and adaptable framework for conducting tax due diligence is paramount. Such a framework equips investors and acquirers with the necessary insights to navigate the intricate tax landscape, ensuring that all potential risks are assessed, and opportunities leveraged, thereby securing the strategic and financial success of their ventures.