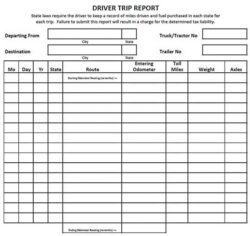

Life on the open road as a truck driver is an adventure filled with independence and hard work. But beyond the miles and the loads, there’s a crucial aspect of the job that often gets overlooked until tax season rolls around: managing expenses. From fuel receipts to toll fees, maintenance costs, and per diem allowances, the sheer volume of financial transactions can quickly become overwhelming, making it difficult to keep a clear picture of your actual income and expenditures.

Many drivers, especially owner-operators, find themselves scrambling at the end of the year, sifting through shoeboxes full of receipts, trying to reconstruct their financial history. This not only adds significant stress but can also lead to missed deductions, costing hard-earned money. An organized system is not just a nice-to-have; it’s a fundamental tool for financial health and peace of mind in a demanding industry.

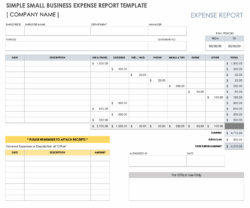

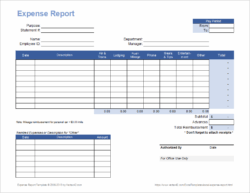

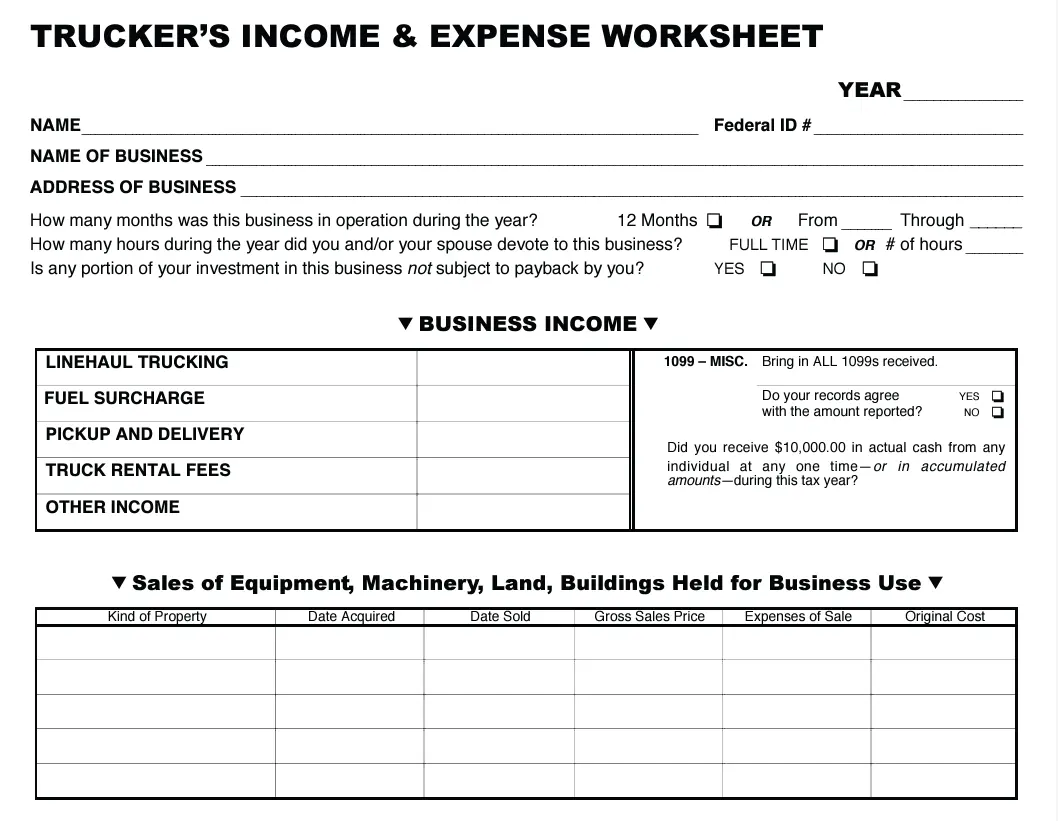

This is where a dedicated and easy-to-use system comes into play. A well-designed truck driver expense report template can transform this daunting task from a year-end nightmare into a manageable, even proactive, part of your routine. It provides a structured way to record every dollar spent, ensuring accuracy, maximizing deductions, and giving you a clear financial overview of your trucking business.

Why a Dedicated Expense Report Template is Your Best Co-Pilot on the Road

Keeping meticulous records of your expenses isn’t just about fulfilling a requirement; it’s a strategic move that can significantly impact your financial well-being. Imagine having a clear, organized breakdown of every cost associated with your operations. This level of detail empowers you to make informed decisions, understand your profitability, and avoid unnecessary financial headaches down the line. A robust expense report template acts as your financial dashboard, giving you real-time insights into where your money is going.

One of the most compelling reasons to utilize a specific template is for tax purposes. The Internal Revenue Service (IRS) allows truck drivers to deduct a wide array of business expenses, from fuel and maintenance to tolls, lodging, and even a portion of your meals (often handled via per diem). Without proper documentation, proving these expenses can be challenging, leading to missed deductions or, worse, issues during an audit. A structured template ensures that every deductible item is recorded, categorized correctly, and supported by documentation, making tax season a breeze rather than a burden.

Beyond taxes, a detailed expense report provides invaluable business intelligence. Owner-operators, in particular, need to know their true operating costs to set appropriate rates, manage their budget effectively, and identify areas where they might be overspending or could save money. Are your fuel costs trending up? Is a particular repair shop charging too much? These are questions easily answered when your expenses are meticulously tracked and organized within a coherent system. It’s about more than just numbers; it’s about strategic financial management.

Furthermore, having your expenses in order brings a significant amount of peace of mind. Knowing that your financial records are accurate and up-to-date eliminates the stress of potential audits or unexpected financial surprises. It allows you to focus on what you do best – driving and delivering – without the constant worry of forgotten receipts or miscategorized spending. This foundational financial organization contributes directly to your overall business stability and personal well-being.

Ultimately, a good template streamlines the entire process. Instead of haphazardly tossing receipts into a glove box, you’ll have a designated place and method for recording each expense as it occurs. This simple act of consistency prevents costly omissions and saves hours of frantic searching later on. It transforms a potentially chaotic task into a simple, routine part of your workday, keeping your financial house in order with minimal effort.

Key Categories to Include in Your Template

- Fuel Costs: This is often the largest single expense for truck drivers, so detailed tracking of every gallon purchased is critical.

- Vehicle Maintenance and Repairs: From routine oil changes and tire rotations to unexpected breakdowns, these costs are essential to keep your rig running.

- Tolls and Parking Fees: Daily operational costs that add up quickly across various states and terminals.

- Lodging and Per Diem: Expenses for overnight stays and allowances for meals and incidental expenses while away from your tax home.

- Communication: Costs associated with your cell phone, internet hotspots, and any other communication tools necessary for your business.

- Supplies: Logbooks, cleaning supplies, personal protective equipment, and other consumables needed for the road.

- Insurance Premiums: Payments for commercial vehicle insurance, cargo insurance, and potentially health insurance if self-employed.

- Licensing and Permits: Fees for CDL renewals, state permits, and any other regulatory requirements to operate legally.

- Professional Fees: Payments to accountants, dispatch services, or other third-party professionals assisting your trucking business.

Getting Started with Your Truck Driver Expense Report Template

Adopting a new system, even one designed to simplify your life, can sometimes feel like an extra chore at first. However, integrating a truck driver expense report template into your daily or weekly routine is simpler than you might think. The key is consistency and finding a rhythm that works for you. Whether you prefer to log expenses at the end of each day, compile them weekly during your home time, or dedicate a specific day each month, the most important thing is to stick with it. Regular input prevents backlogs and ensures accuracy, capturing details while they are still fresh in your mind.

For the most effective expense tracking, remember to keep every receipt. In today’s digital age, this doesn’t necessarily mean holding onto crumpled pieces of paper. Many drivers find it incredibly helpful to take a quick photo of each receipt with their smartphone immediately after a purchase. These digital images can then be easily uploaded or attached to your expense report, providing clear proof of expenditure without the physical clutter. There are also various apps designed specifically for receipt scanning and expense tracking that can integrate seamlessly with a digital template.

Finally, remember that while a good template provides a solid framework, it should also be adaptable to your unique needs. You might find that some categories are more relevant to your specific type of hauling or your business structure. Don’t hesitate to customize a general template by adding or removing fields to better reflect your actual spending patterns. Whether you use a simple spreadsheet, a dedicated software program, or a print-and-fill document, making the template work *for* you is paramount to its long-term success and your financial clarity.

Taking control of your expenses empowers you to see the true financial landscape of your trucking career. It moves you from merely being a driver to being a savvy business operator, with a clear understanding of your cash flow and profitability. This proactive approach to financial management is a cornerstone of long-term success on the road, allowing you to maximize your income and minimize stress.

Equipping yourself with an effective truck driver expense report template isn’t just about paperwork; it’s about smart business management, securing your financial future, and making informed decisions that drive your career forward. It’s an investment in your peace of mind and a crucial step towards building a resilient and profitable trucking operation for years to come.